Strike Overview

- With the 2024 elections approaching, costs for ad auctions mixed with political campaign ads are anticipated to increase further this year, with 50% of political dollars expected to be spent during the last 30 days leading up to the election.

- Advertisers are left questioning whether they should pause their advertising during the elections, considering the intense competition not only from the Democratic and Republican parties but also from independent parties and candidates who are also contributing to the political ad spending.

- We’ve gathered the data and insights to help you determine whether it’s worthwhile to advertise alongside the surge in political ad spending during the month of October.

Jump to Section

Get exclusive content on paid social media.

Join our mailing list for the latest updates.

With Political Campaigns Driving Up Ad Spend, Should You Pause Your October Ads?

As of August 2024, $385 million has already been spent on political ads, with an additional $322 million scheduled. The total U.S. political ad spending is expected to hit $1.4 billion for this presidential election, with around $695 million projected to flood the market in October as campaigns make their final push before the November 5 election.

Political ad spending is set to be 35% higher than during the same period in 2020. With this surge, should you expect higher social media advertising costs in October? What should you be preparing for to optimize ad spending and maintain performance across your campaigns?

The Data: What Our Campaigns Reveal About the Political Advertising Season

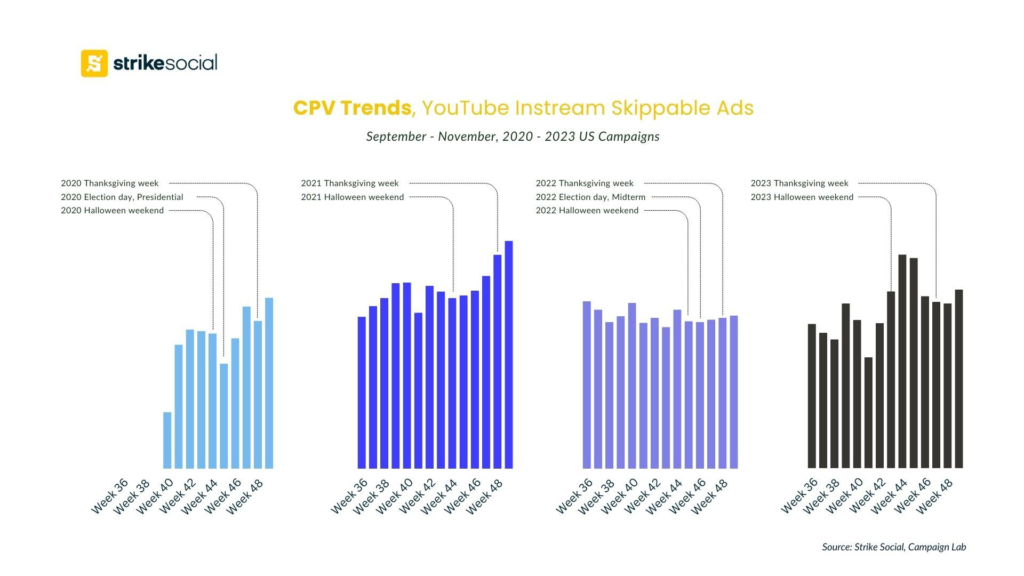

To understand the impact of political advertising in October, we analyzed data from our YouTube campaigns spanning 2020 to 2023. Notably, the last U.S. presidential election occurred in 2020, coinciding with the height of the COVID pandemic when consumers were largely confined to their homes.

This unique context resulted in significant shifts in digital advertising strategies. From 2021 to 2023, we observed a notable increase in digital ad adoption across social media platforms. Advertisers adapted to changing conditions, and audiences grew accustomed to diverse advertising formats.

During election season this year, what trends should you expect as U.S. political ad spending rises again?

Mobile Viewing is Still Winning

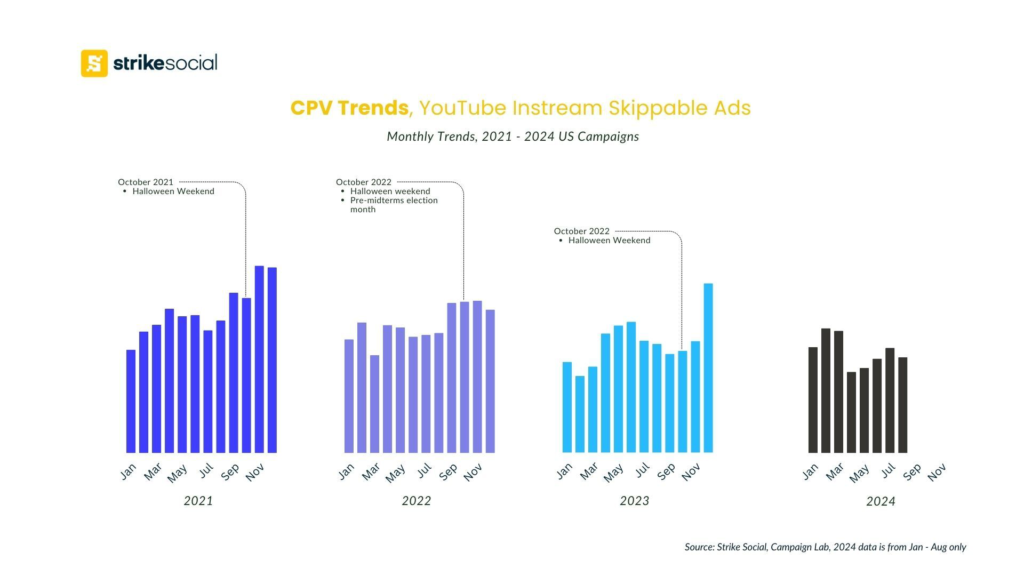

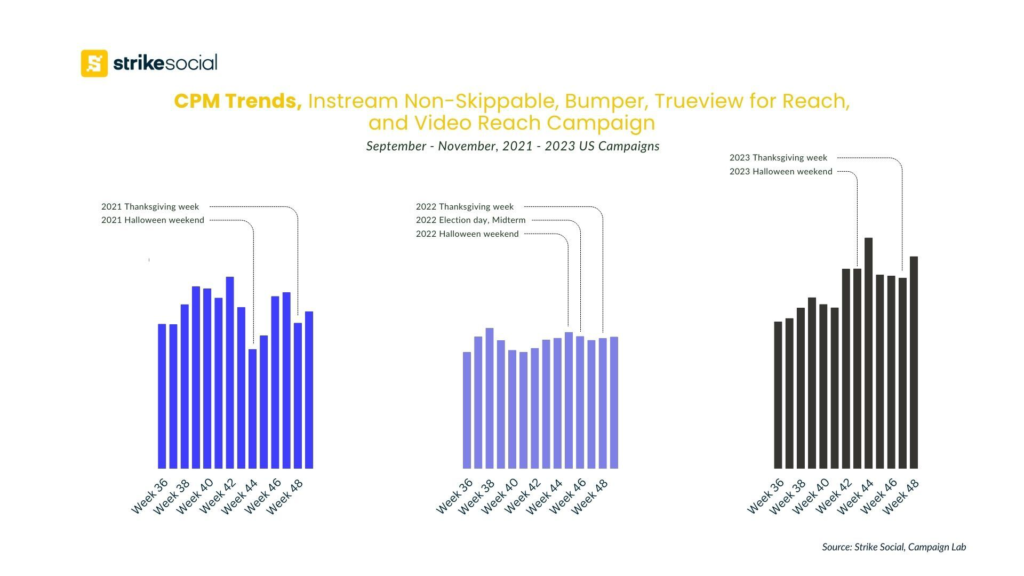

According to the data from Strike Social’s proprietary tool, Campaign Lab, YouTube’s year-on-year Cost-per-View (CPV) trends may appear erratic from September to November. However, while there was a notable spike in 2021, the cost for Skippable Ads normalized by 2022. Despite some fluctuations in 2023, CPV rates remain relatively stable, particularly except for the weeks between Halloween and Thanksgiving.

Video View Campaigns (VVC) offer flexibility that allows YouTube Skippable ads to reach highly engaged audiences already interested in similar content. Since the introduction of YouTube Shorts as an ad format in 2021, advertisers have explored new opportunities, and by 2022, ad costs had stabilized. According to Nielsen’s 2024 data, YouTube now holds the highest share of watch time among TV viewing platforms. With VVC’s versatile ad placements, YouTube Shorts are not only gaining traction on mobile but are also increasingly viewed on YouTube Connected TVs.

The steadiness in CPV costs during the 2022 U.S. midterm elections can be attributed to the localized nature of political advertising, which resulted in fewer significant spikes as ad spending was distributed across various states. Consequently, advertisers could maintain more stable auction bids without the pressure of dramatically increasing costs to reach broader audiences.

It’s no secret that people are spending more time on their smartphones, and this change has significantly impacted YouTube advertising. YouTube watch time in the U.S. has grown from 45 minutes in 2021 to 48.7 minutes in 2024, with mobile viewership increasing from 63% to 70% over the same period.

When examining the year-over-year CPV trends, it becomes evident that, by this year, CPV is either improving or remaining consistent with last year’s figures due to increased mobile viewing behavior.

Mobile ad placements are thriving with the rise of bite-sized content such as YouTube Shorts. Although CPV is likely to experience a spike in October, especially in the 1-2 weeks leading up to the key election date, it is expected to remain steady even during holiday campaigns.

Consistency in Engaged Views

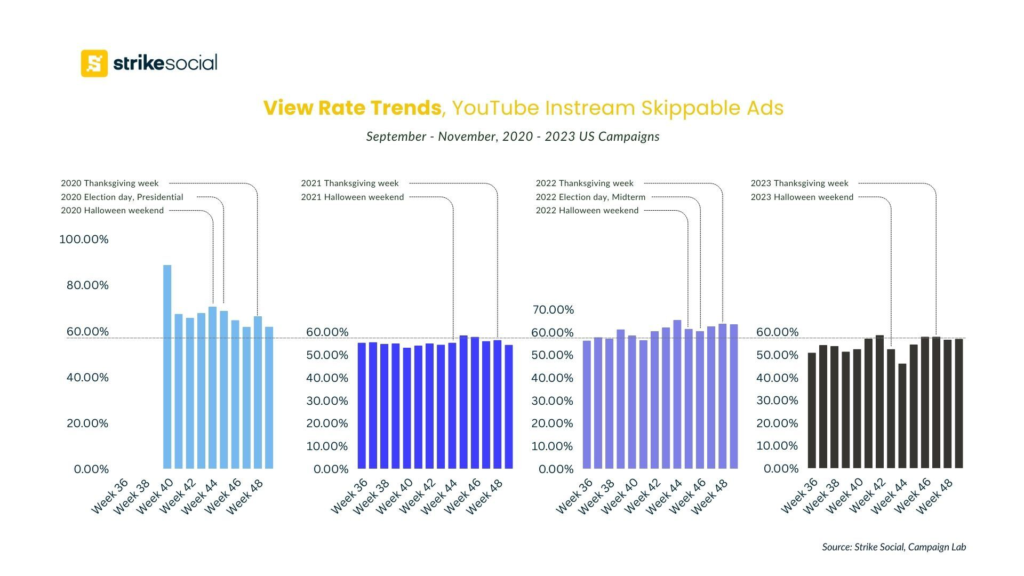

Contrary to the belief that political ads might deter viewers from social media platforms, recent findings suggest they actually enhance attention to brand advertisements. In fact, 43% of Americans report that non-political ads are more acceptable or even more likable during periods of heightened political advertising.

As a result, view rates for YouTube Skippable Ad campaigns have remained consistent. We anticipate similar outcomes this year as the U.S. presidential election approaches.

Historically, during election years—both presidential and midterm—view rates exceed 60%, indicating that political ads do not negatively impact brand visibility. Instead, they drive increased engagement with non-political advertisements in users’ YouTube feeds.

Battle for Expanding Reach on CTV

Awareness campaigns are increasingly focused on expanding reach, particularly as YouTube Video Reach campaigns adopt a multi-format approach. This strategy combines bumper ads, skippable in-stream ads, in-feed ads, and YouTube Shorts ads.

In June this year, Google TV was added to Video Reach Campaigns, joining YouTube TV and other Connected TV placements within the Google Display Network (GDN).

With limited inventory for non-skippable ads on YouTube, brands are being nudged toward Video View Campaigns for greater flexibility in ad placements. While non-skippable ads remain a strong tool for reaching audiences, Video View Campaigns offer more dynamic options for ensuring your brand or ad is seen, whether users are scrolling through their feed or viewing YouTube video content.

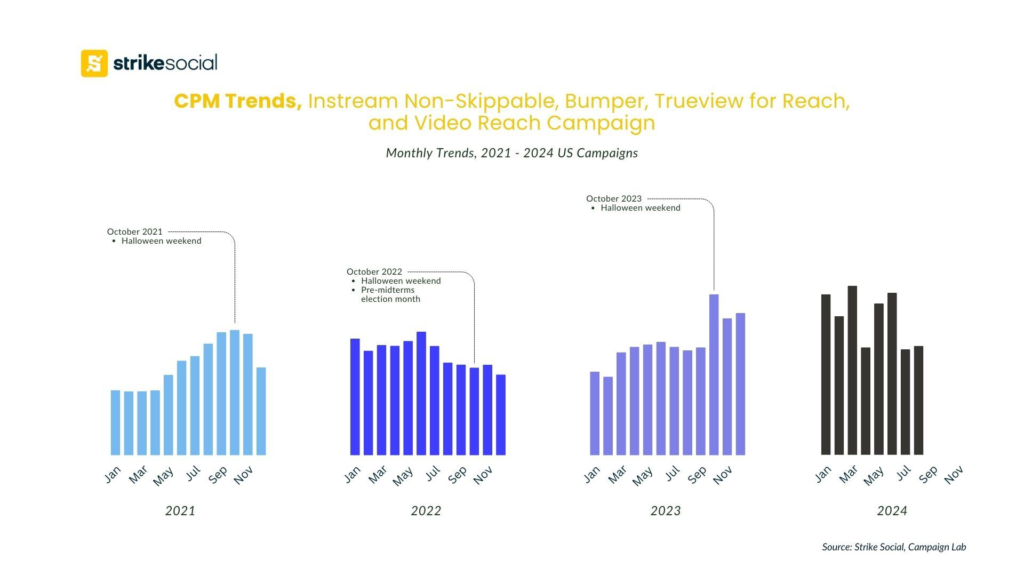

As we look toward Q4 of 2024, current trends indicate that Cost Per Mille (CPM) rates are likely to exceed last year’s, with Q1 and Q2 showing significantly higher CPMs than the previous year. A striking 72% of YouTube Connected TV users report feeling a deeper connection to their viewing experience, leading to higher engagement rates. This increased affinity drives advertisers to allocate more ad spend toward reaching Connected TV audiences.

With approximately 8 million subscribers on YouTube TV, competition for CTV ad placements is intensifying. As more advertisers vie for these premium placements, CPM rates are expected to rise.

Put Your Video Ads Into Action

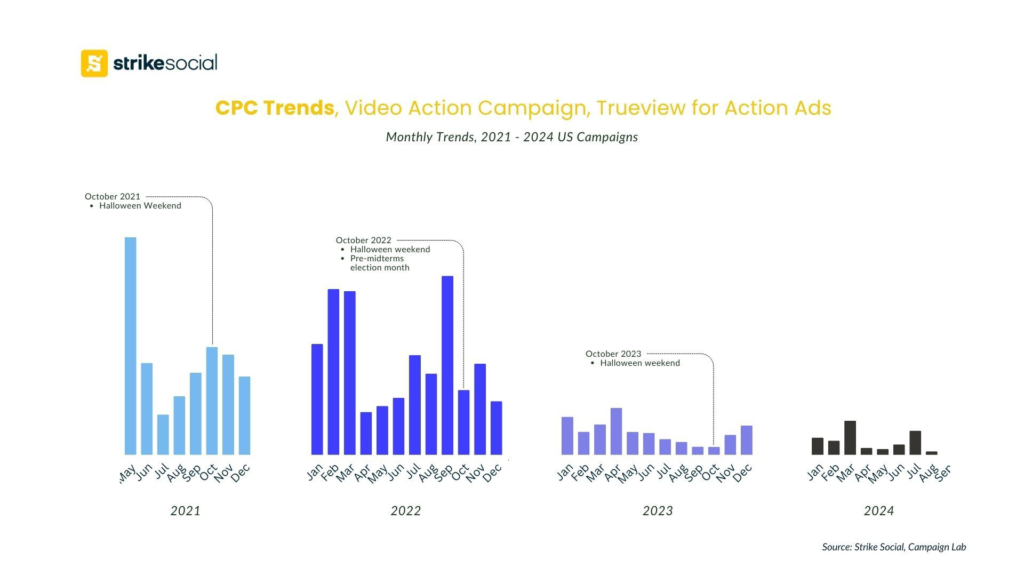

As the ad market for reach campaigns becomes increasingly congested, lower-funnel campaigns are emerging as a cost-effective solution this year. Our YouTube TrueView campaigns focused on clicks have shown an overall decline in advertising costs, although a notable peak occurred in 2022, just before Halloween weekend and the midterm elections.

This spike in 2022 can be attributed to the lifting of COVID-19 restrictions, which allowed businesses to reopen and encouraged brands to drive foot traffic back to physical stores through clickable ads. In the wake of the pandemic, many companies ramped up their digital marketing efforts to capture consumer attention, resulting in a bidding war for ad placements on YouTube that drove cost-per-click (CPC) rates higher.

By 2023, CPC rates began to stabilize, and many even fell below previous levels, indicating a shift back toward reach and awareness campaigns in YouTube advertising.

Looking ahead to 2024, we anticipate CPC rates will remain similar or lower than last year. YouTube Shorts are leading the charge in viewer engagement through Video Action Campaigns (VAC), enabling advertisers to gauge how audiences interact with content and creators, particularly those providing edutainment.

As VAC transitions into Demand Gen, advertisers are evaluating whether to continue their VAC ads in this new context. With a full transition expected by 2025, caution prevails, allowing CPC rates to remain steady and potentially drop even further compared to previous years.

Further Reading

Key Events Shaping Political Advertising Spending in 2024

Numerous events have already shaped political ad spending during this U.S. election cycle, and more are likely to emerge as we near election day. Considering the evolving political dynamic, substantial shifts could still occur. Examine the major events and their implications for trends in political ad spending throughout 2024.

The Verdict: Should You Pause Your October Campaigns to Make Way for Political Ads?

It’s clear that the surge in political campaign ads will lead to increased ad auction costs. However, Strike Social’s YouTube data indicates that costs can be volatile and unpredictable, particularly during the final three months of the year when major holidays, from Halloween to New Year’s Eve, begin.

With the anticipated rise in political ad spending this Q4 2024 likely to drive up auction costs, you may wonder whether it’s wise to pause your October campaigns. Fortunately, there are strategies you can employ to optimize your advertising efforts during this period:

Content Relevance & Viewability

Data from Ipsos reveals that 78% of U.S. audiences appreciate non-political ads as a welcome break from the often negative tone of political advertising. This suggests that now is not the time to pause your YouTube or any ongoing paid social media campaigns; instead, this period can prompt viewer engagement with your brand.

Furthermore, iSpot.tv’s findings indicate that 31% of U.S. viewers report no impact from brand advertisements alongside political ads.

What should brands and advertisers do:

In addition to keeping your YouTube campaigns always-on, it is important to communicate your brand’s messaging proactively. Ads that embody a positive tone can distinguish themselves from the negativity often associated with political ads.

Research indicates that as users scroll through their social media feeds, engaging and even humorous brand ads contribute positively to your brand’s perception, increasing brand recall and boosting attention to your ads by 27% overall.

Contact Us

Scale your YouTube reach and action campaigns with an AdTech agency that can help you achieve a 10-20% improvement in outcomes.

Strategic Location Targeting

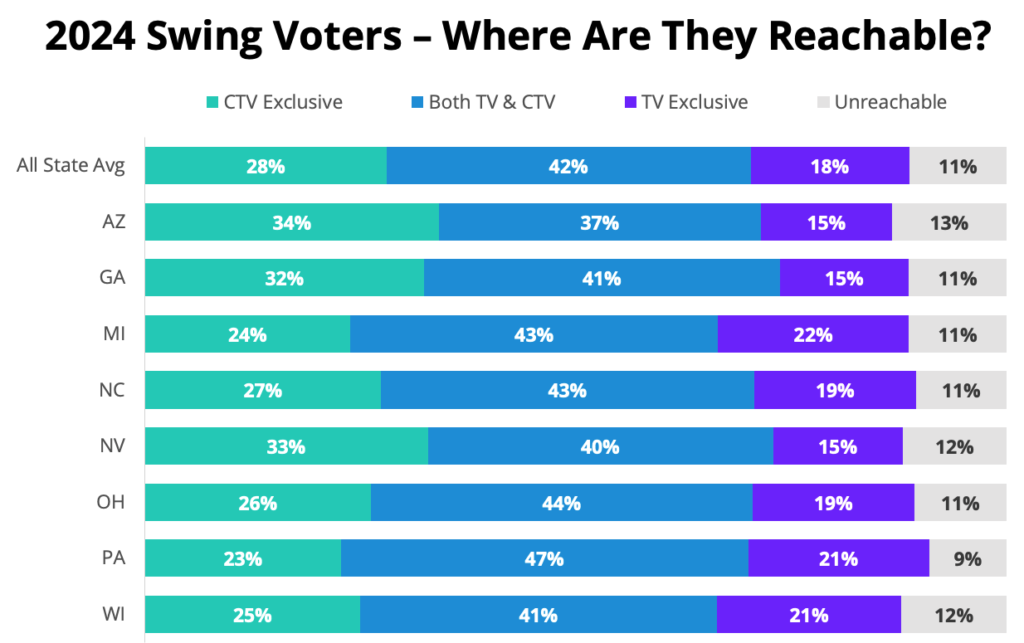

As the U.S. presidential election draws closer, both Democratic and Republican parties are poised to invest heavily in key swing states with significant voting power. If your budget is limited or you aim to control your YouTube ad costs, consider shifting your focus to non-swing states while maintaining nationwide targeting.

Projected data indicates that 76% of total U.S. political ad spending for presidential campaigns will be concentrated in major states like Pennsylvania, Michigan, and Wisconsin. In addition, AdImpact reports that Democrats have already outspent Republicans by $100 million in August alone, highlighting the competitive ad rates in these “battleground states”.

In these seven critical swing states—Pennsylvania, Arizona, Georgia, Michigan, Nevada, North Carolina, and Wisconsin—ad costs are expected to increase significantly compared to non-swing states.

What should brands and advertisers do:

If your brand targets a nationwide audience, consider concentrating your ad spend on reach campaigns in non-swing states. As evidenced by our CPM data, reach campaigns are trending upward, but competition will intensify as presidential ads capitalize on Connected TV’s advanced geo-targeting capabilities.

On the other hand, if your target market includes any swing states this election, you can still succeed in ad auctions by pivoting to lower funnel campaigns. This year, costs for YouTube TrueView campaigns focused on clicks show a favorable trend, offering a viable strategy as brands and political advertisements increasingly vie for attention in the awareness and reach markets.

Timing is On Your Side

Political campaign ads operate on a tight deadline, while your advertising efforts can remain flexible. In the ten days leading up to Election Day, we can anticipate another influx as the final 25% of U.S. political ad spending is invested in a last-minute effort to sway or encourage voters.

During election week, political advertising agencies will reduce or completely halt their campaign ads. For instance, Meta has a policy of blocking new political, electoral, and social issue ads in the final week of the U.S. election campaign.

What should brands and advertisers do:

As you run your brand’s ads alongside political campaigns this October, you have the advantage of capturing audience attention right as Halloween comes to a close. This period marks a transition into holiday advertising, making it an ideal time to engage consumers.

Don’t let this opportunity pass; Thanksgiving and Christmas are just around the corner. When political ad spending begins to decline, you can ramp up your advertising efforts to ensure your message reaches consumers before your competitors can make their mark. By strategically timing your campaigns, you can position your brand to stand out during a crucial moment.

Staying Visible Amid the Political Ad Spend Surge

October is not the time to pause but rather an opportunity to prepare for the holiday rush and capitalize on the ad space after the election. Pausing your campaigns can result in lost momentum, requiring you to restart the learning period, regain your ad auction positions, and relearn optimal bidding strategies—all due to the fear of rising costs from increased political ad spending.

The good news is you can partner with an agency that ensures you maintain your pace and strive to drive lower costs for your campaigns. At Strike Social, we focus on delivering consistent results throughout your campaign while minimizing ad costs, so you don’t have to worry about high additional fees when working with a YouTube advertising agency.

Request a personalized walkthrough with our team to explore our SWAS (Software with a Service) offerings and discover how we can help you thrive during this competitive season.