Strike Overview

- Thanksgiving advertising trends reveal predictable cost shifts across Meta, YouTube, and TikTok, helping advertisers anticipate CPM, CPC, and CPV changes to plan Q4 campaigns more efficiently.

- Insights from Strike Social’s data break down the season into three actionable phases: early audience building, high-intent conversion peaks, and post-BFCM (Black Friday-Cyber Monday) retargeting opportunities, guiding smarter campaign pacing and budget allocation.

- Learn how to forecast and execute cost-efficient campaigns across platforms by applying these Thanksgiving and Black Friday advertising trends to strengthen your Q4 media strategy.

Jump to Section

Thanksgiving Advertising Cost Trends: Benchmarks and Campaign Tactics

Over the years, Thanksgiving advertising trends have revealed sharp cost spikes across platforms, often unpredictable and always competitive. As Q4 approaches, every advertiser faces the challenge of balancing rising social media ad costs with reliable campaign performance.

By analyzing campaign data from Meta, YouTube, and TikTok, our team identified patterns that reveal how ad costs and performance fluctuate throughout the Thanksgiving season.

These insights give you the power to forecast more effectively for Thanksgiving 2025, helping you plan campaigns that remain efficient, profitable, and ahead of the holiday rush.

Understanding the Thanksgiving Advertising Season in Three Phases

The Thanksgiving advertising season consists of three distinct phases, each with its own unique audience behavior, competitive intensity, and cost structure.

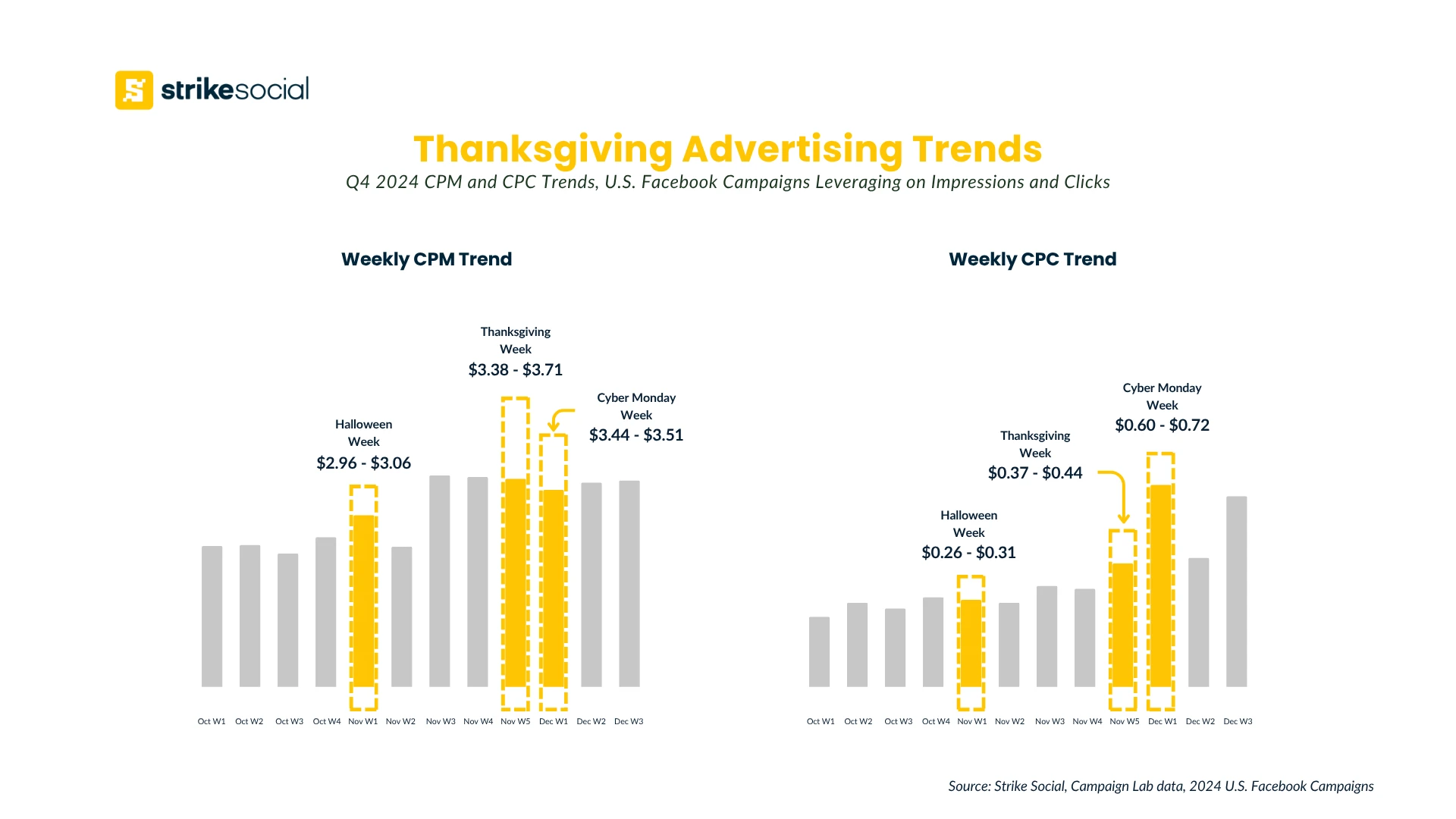

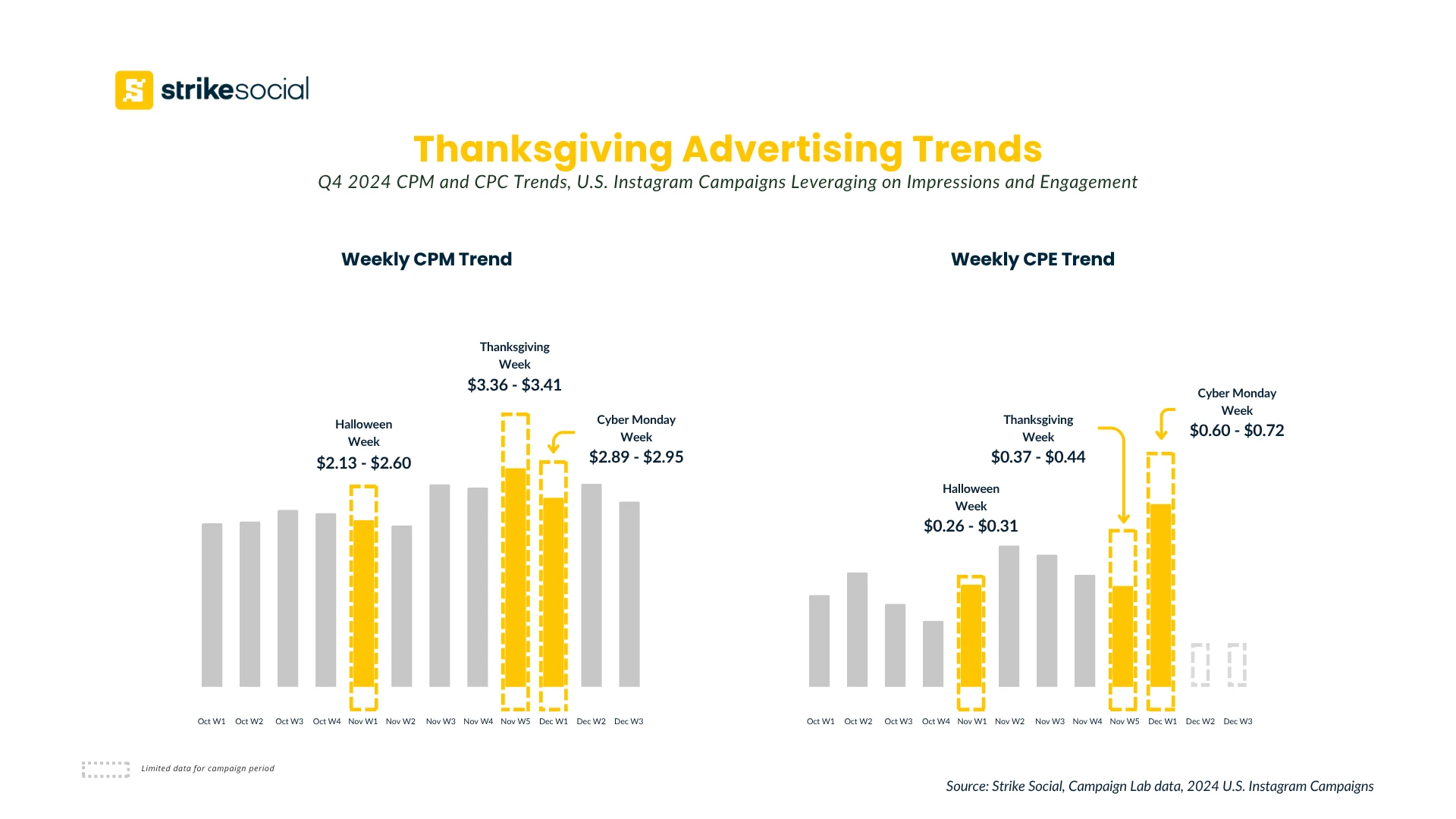

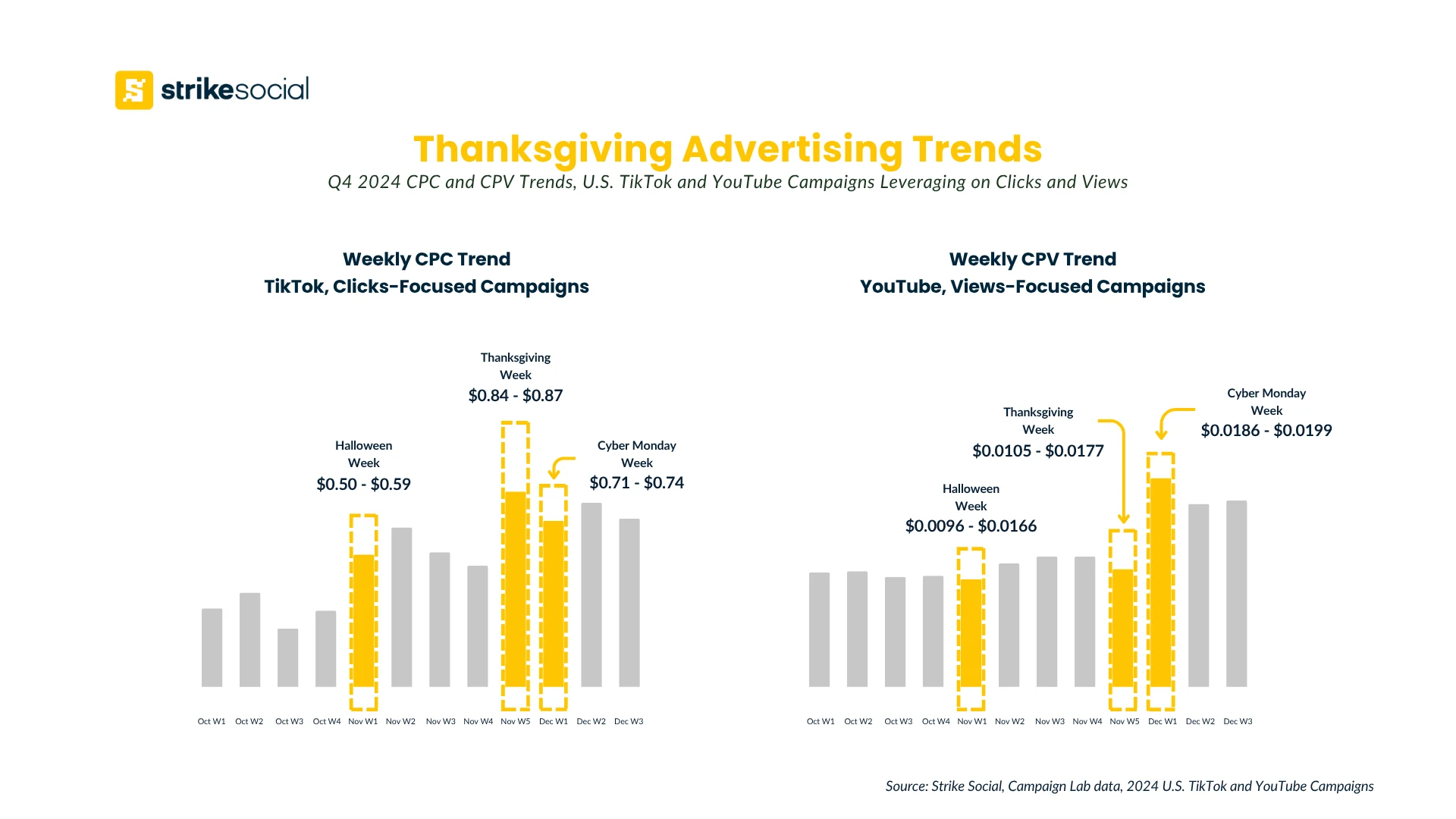

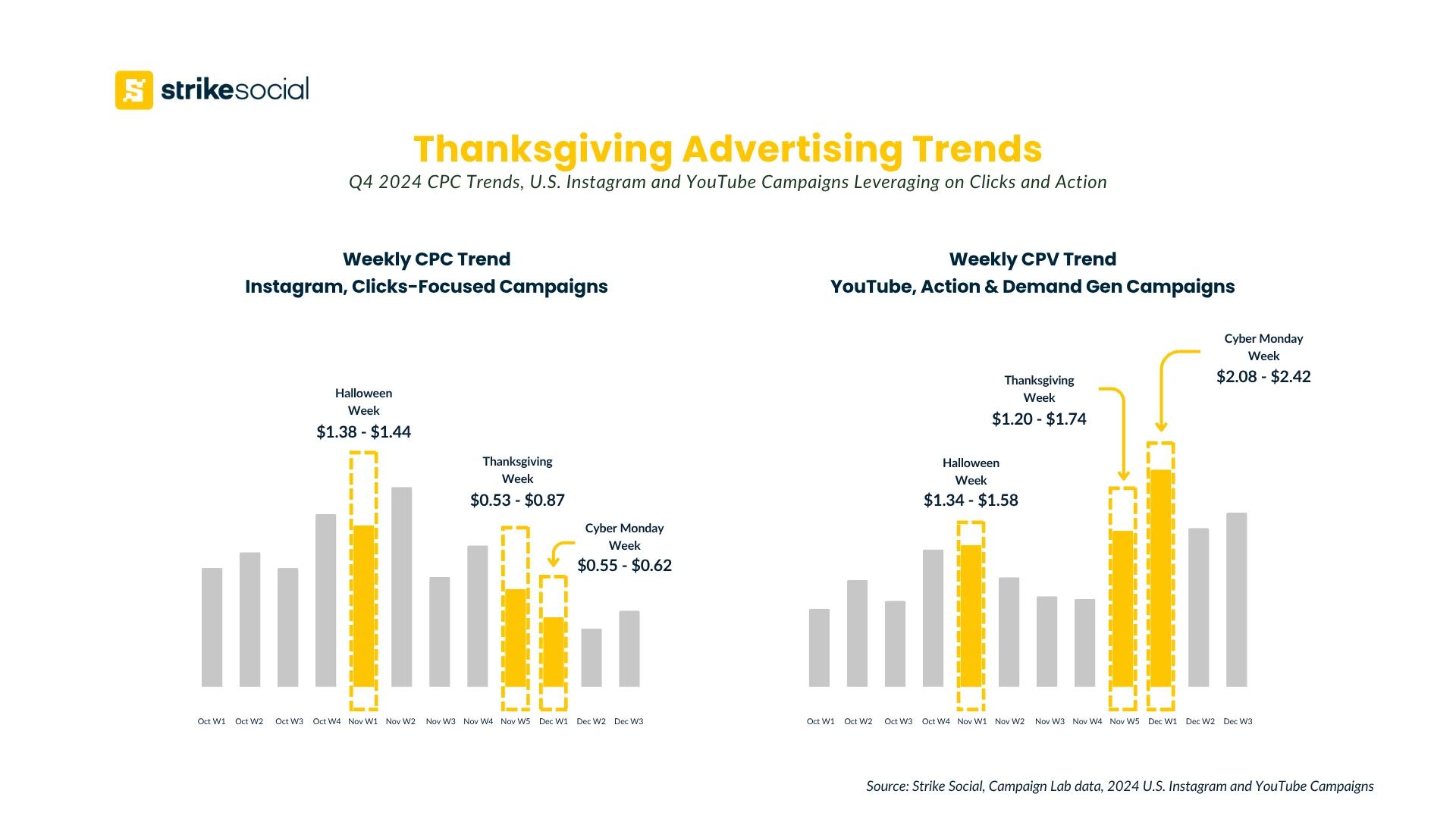

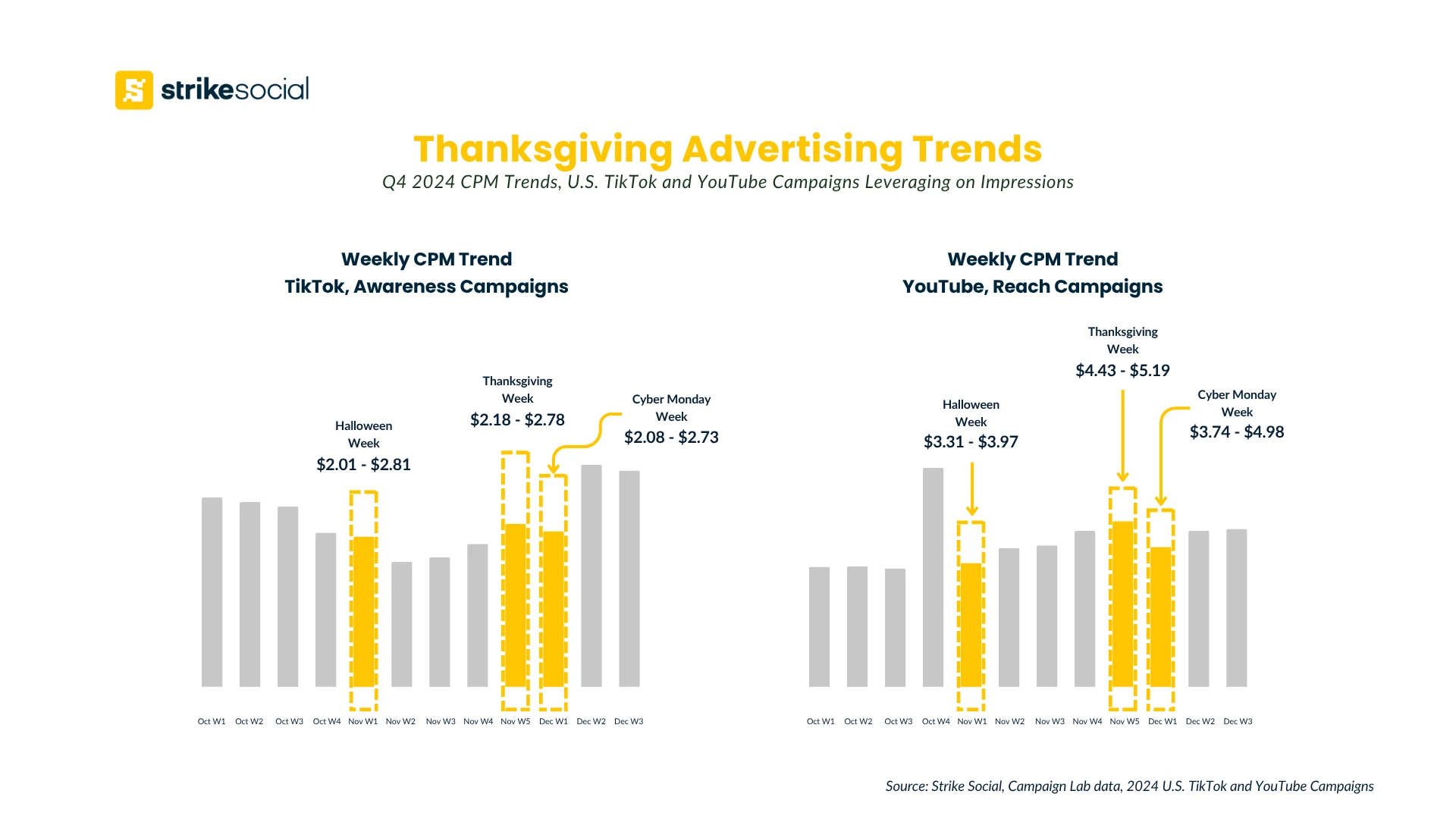

From our analysis of Strike Social’s 2024 campaign data, a consistent trend emerged: ad prices rise sharply, then stabilize as engagement dynamics shift closer to Thanksgiving. By tracking weekly movements in CPM, CPV, and CPC, we can now identify when ad costs are likely to increase and when the best opportunities arise to maximize ad cost efficiency.

Phase 1: The Post-Halloween Warm-Up

The period immediately following Halloween through mid-November is the strategic opening act for Thanksgiving advertising. Competition is building but hasn’t yet reached full intensity, creating a critical window for media buyers to capture audiences at lower social media ad costs.

Our 2024 data show that this “warm-up” phase offers major efficiencies for advertisers who start their campaigns early, allowing them to capture mindshare before the peak pricing of Thanksgiving and Black Friday week.

Here’s what our data reveals:

Facebook: During this phase, Facebook campaigns focused on awareness achieved notable cost efficiency. CPMs during Halloween week were 15% lower than peak Thanksgiving week costs, while CPCs were 46% more efficient than during the high-demand Turkey 5 marketing period. This makes it the best time to build your retargeting pools before competition and ad costs spike.

Instagram: Impression-based ads on Instagram during Halloween week were 18% more efficient than during peak Thanksgiving and Black Friday weeks. Costs for post engagement campaigns also dropped, signaling users’ “window shopping” mindset. This is a prime opportunity to serve gift guides and brand teasers, warming up audiences who will engage more deeply once the sales officially begin.

TikTok: The average CPC during Halloween week was 24% more efficient than the average click costs during Thanksgiving and Cyber Week. This highlights the platform’s value in driving initial site traffic – not just awareness, allowing you to learn what resonates with your audience before scaling your budget for the main event.

YouTube: Competition for reach campaigns spikes during Halloween week itself, but a favorable trend emerges in the following weeks leading up to Thanksgiving. The key efficiency during this phase was in viewership; our data shows that YouTube ad costs, particularly the cost-per-view (CPV) during Halloween week, offered a 34% efficiency.

This is the moment for story-driven video ads: build brand narratives and product familiarity before the market becomes more competitive.

For Thanksgiving 2025, treat the post-Halloween period as your audience-building runway. Utilize this mid-November window to fund awareness and retargeting efforts while costs are low. By entering the market early, you’ll capture attention and performance data that strengthen your campaigns ahead of Black Friday, Cyber Monday, and the holiday rush.

Phase 2: Advertising Costs During Thanksgiving, Black Friday, and Cyber Monday Week

From Thanksgiving week through Cyber Monday, user intent reaches its annual peak. Consumers are primed to buy, and competition among advertisers intensifies across all major social media ad platforms.

Here’s a snapshot of how key metrics surged from the mid-November baseline to the late-November peak:

| Platform | Peak Metric | Baseline (Mid-November) | Peak (Late November) | % Change |

|---|---|---|---|---|

| CPC | $0.17 – 0.34 | $0.26 – $0.58 | +70% | |

| CPM | $2.83 – $2.93 | $3.13 – $3.18 | +8% | |

| TikTok | CPC | $0.60 – 0.62 | $0.81 – $0.85 | +30% |

| YouTube | CPC | $1.07 – $1.10 | $2.08 – $2.33 | +94% |

Surge in Conversion-Focused Costs During Thanksgiving Week

While some top-funnel metrics showed moderate increases, the biggest cost surges occurred in bottom-funnel performance campaigns as brands fought aggressively for sales.

YouTube: CPCs nearly doubled, reflecting fierce competition for video ad placements during Thanksgiving and Black Friday week. These Thanksgiving advertising trends reveal high-stakes bidding for viewers who are in the final stages of making a purchase.

Facebook: Central to driving holiday sales, Facebook CPCs jumped 70%, reaffirming Facebook’s role as a primary conversion engine of holiday advertising. Advertisers willingly paid premium rates for high-intent clicks and purchase-ready audiences.

TikTok: Advertising costs, particularly CPCs, increased by 30% during Thanksgiving and Cyber Monday week, indicating a shift in behavior from entertainment and discovery to active buying intent. TikTok continues to shape Thanksgiving advertising trends, with users rapidly progressing from brand discovery to purchase decisions.

Instagram’s Stability During Thanksgiving Advertising Season

Here’s where our data gets interesting: Instagram didn’t follow the pattern everyone expected.

While Instagram’s CPM increased modestly by 8%, its CPC actually decreased, bottoming out at $0.62 during Cyber Week.

The data points to an audience that was highly intent-driven during this period. Despite increased competition for impressions, Instagram rewarded brands with strong creative and compelling Cyber Monday deals, generating more efficient conversions at lower click costs.

During Thanksgiving 2025, Instagram remains a powerful channel for brands with sharp creative strategies. If your offer stands out, the platform can outperform its cost benchmarks even in high-demand weeks.

Further Reading

Understanding Instagram Ad Costs for Better Budget Planning

Your Instagram ad spend changes depending on audience targeting, campaign goals, and performance in Meta’s auction system. Learn the main cost factors, standard benchmarks, and formulas that help set an efficient campaign budget.

Phase 3: The Post-BFCM Cool-Down

The term “cool-down” may be a misnomer: costs don’t simply drop after Cyber Monday. Our data from early to mid-December shows that while some costs recede, others remain surprisingly high as the final holiday shopping push continues.

Efficiency in Clicks for Last-Minute Conversions

Instagram advertisers saw a clear opportunity in early December. Average CPCs dropped by 20% compared to the Thanksgiving and BFCM peak, signaling a more efficient window for conversion-focused campaigns. This creates a prime opportunity for advertisers to retarget holiday shoppers who have previously shown interest, converting them into customers at a significantly lower cost.

YouTube followed a similar pattern. CPCs cooled by roughly 10% from BFCM highs, particularly in Video Action and early Demand Gen campaigns. Though not back to pre-holiday levels, this represents a strong re-entry point for brands aiming to re-engage warm audiences with direct, action-oriented messaging.

Sustained Competition for Awareness

Interestingly, TikTok moved in the opposite direction. The platform’s average CPM rose by 31% in early December compared to the Thanksgiving and Cyber Monday period. This signals TikTok’s growing role as a “final push” platform, where brands compete fiercely for trend-driven shoppers still in discovery mode.

YouTube’s Video Reach Campaigns remained comparatively stable, with only a 5% CPM increase in early December versus the BFCM peak. While not a dramatic jump, this steady competition underscores the importance of careful pacing and continuous optimization to maintain cost efficiency and consistent visibility through year-end.

Contact Us

Work with an AdTech agency partner that can improve 10-20% of your campaign outcomes.

Learn how Strike Social can be an extension of your in-house team.

Building Your Plan Using These Thanksgiving Advertising Trends

So, how do you put these insights into action? Based on the campaign data and consumer behavior trends, here’s a roadmap to plan smarter and spend more efficiently this Thanksgiving advertising season.

Anticipate the CPC increase. As the data has shown, click costs will double or more during the peak period. The best strategy is to get ahead of it.

According to Numerator, 85% of Thanksgiving shoppers make purchases between one to eight weeks before the holiday. This early window is your advantage. Launching campaigns in early to mid-November allows you to drive performance before competition intensifies and costs spike.

Pivot to retargeting in Early December. Once the BFCM surge subsides, click costs on platforms like Instagram and YouTube cool off, creating an opportunity to retarget efficiently.

This is the time to re-engage audiences you built during the pre-Thanksgiving and peak phases, converting interest into purchases at a lower cost per click. Treat post-Thanksgiving not as a time to pause, but as your second conversion window.

Don’t underestimate the late surge for awareness. While conversions stabilize in early December, awareness competition stays high, especially on TikTok. Our data shows TikTok CPMs rose post-Cyber Monday, signaling that trend-driven, last-minute holiday shopping continues into mid-December.

Maintain or even increase top-of-funnel budgets here to capture this “final wave” of active discovery and impulse buyers.

At the same time, reignite reach campaigns across Meta and YouTube, where CPMs have stabilized. This keeps your brand visible as the market transitions into the Christmas and New Year ad season, ensuring your Q4 strategy stays active and profitable through year-end.

Strategic pacing wins Q4. Build early, convert during the cooldown, and stay visible through the final awareness surge. This approach applies whether you’re running Black Friday, Cyber Monday, or broader Thanksgiving advertising campaigns, and ensures your media spend works harder across every phase.

The Strategic Advantage of A Well-Rounded Holiday Advertising Plan

The Q4 holiday season will always be competitive, but costs aren’t chaos. Our data shows that Thanksgiving advertising trends follow consistent, predictable patterns across platforms year after year.

By understanding these intricacies, you can recognize Facebook and YouTube’s sharp CPC spikes, Instagram’s unexpected efficiency during peak periods, and TikTok’s late-season surge in awareness, allowing you to move from reacting to performance shifts to anticipating them with precision.

That’s the real advantage advertisers can get – turning insights into strategy. By knowing exactly what to expect and planning accordingly, you’re en route to winning Q4 holiday advertising campaigns.

Article by

Lee Baler, Strike Social’s VP of Sales & Strategy

Lee leads global strategy, helping clients and agencies maximize YouTube and paid social performance. Constantly tracking industry trends, he translates insights into strategies that help brands stay competitive and achieve sustained profitability.