Strike Overview

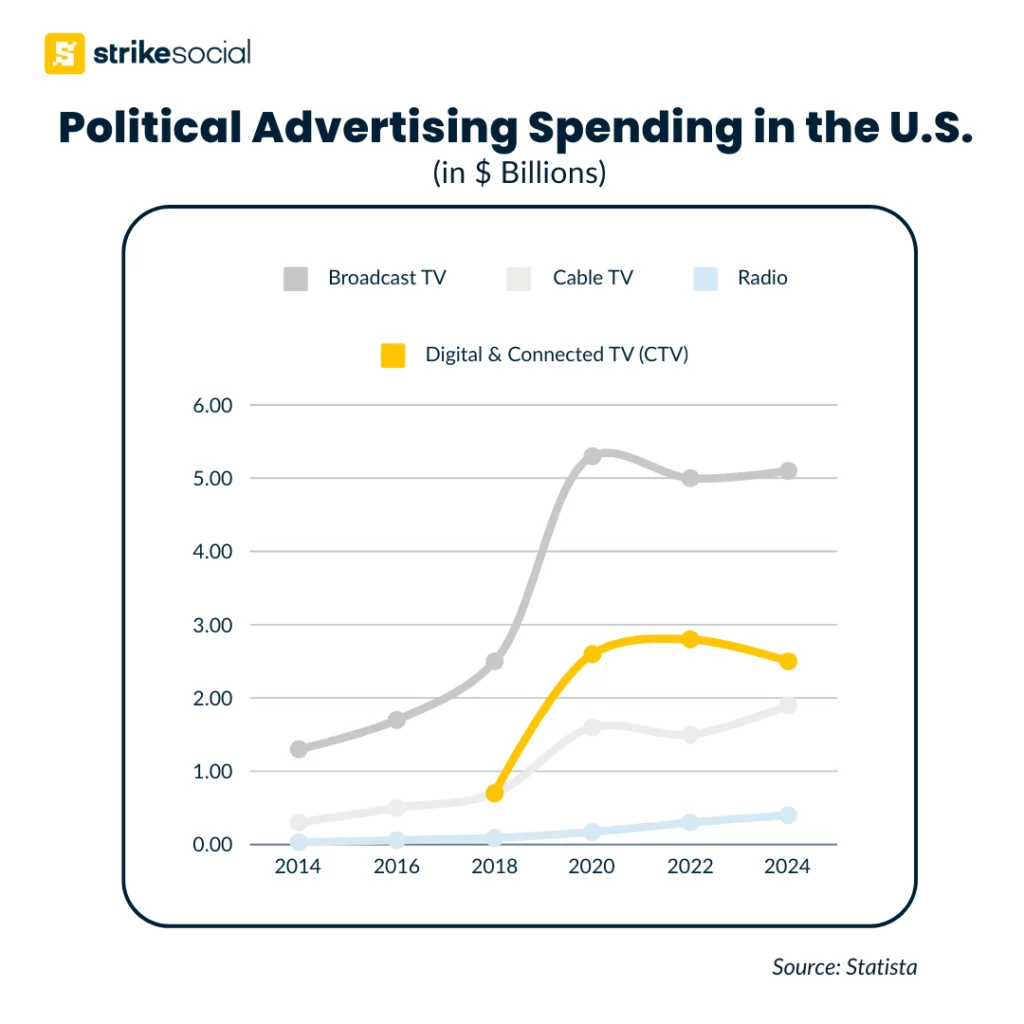

- As we approach the U.S. presidential election, 2024 political ad spending is projected to rise by nearly 30% compared to 2020.

- This surge is already evident across various traditional and digital marketing channels, creating a competitive space in social media advertising.

- For non-political advertising agencies, this means anticipating increased competition for ad space and higher costs as the election draws nearer.

Jump to Section

Recent developments are poised to significantly change the trajectory of the elections and political advertising in general. To make informed decisions about your ad strategies and budget allocations, we must first analyze the key events and what they mean for the 2024 political ad spending trends.

What Are the Major Events Impacting 2024 Political Ad Spending?

Several events have already influenced – and will continue to influence – political ad spending during this U.S. election cycle. Currently, the projected U.S. political ad spend for 2024 is expected to exceed $12 billion, reflecting a 24% increase from the 2022 midterm elections. However, given the dynamics of recent political events, there is still potential for significant changes as we approach election day.

June 27: The First Presidential Debate Sparks Hesitation Among Biden Supporters

The initial presidential debate between former President Donald Trump and President Joe Biden revealed notable weaknesses in the latter’s performance. His lackluster delivery, characterized by a hoarse voice and unclear responses, raised concerns among his supporters.

| “What we witnessed was a very ill Joe Biden struggling to make sense of his own jumbled and meandering thoughts.” – Sean Tully, Baltimore | “Why hasn’t President Biden been evaluated… so we can all know… about his state of health and his ability to carry out his duties as president?” – Susan Talbott, Tuscany-Canterbury | “Biden’s problems aren’t momentary and aren’t merely because of a bad debate performance.” – Harry Enten on X |

July 13: Attempted Assassination of Former President Trump During Pennsylvania Rally

As Republican presidential nominee Trump spoke during a campaign rally in Butler, Pennsylvania, multiple shots were fired toward his direction, barely missing him, with one of the shots injuring him on his right ear. Trump was pronounced safe, but the incident has been classified by the FBI as a potential act of domestic terrorism.

July 16: Dismissal of One of the Three Remaining Criminal Cases Against Trump

In mid-July, Former President Donald Trump was cleared of one of the three remaining criminal cases against him. This dismissal follows a different fate in another case: a conviction on 34 felony counts related to the 2016 election.

Despite these convictions, Trump’s ability to continue his presidential campaign remains intact, especially as sentencing has been postponed until September.

July 21: President Joe Biden Drops Out of the 2024 U.S. Presidential Race

President Joe Biden, initially committed to running for re-election, officially withdraws from the 2024 presidential race. Biden has since nominated Vice President Kamala Harris as the new Democratic presidential candidate.

July 23: Vice President Kamala Harris Steps In as the Democratic Nominee

Vice President Kamala Harris officially accepted the Democratic Party’s nomination for President. With this endorsement, Harris is set to challenge Former President Donald Trump and four independent and third-party candidates.

Budget Allocation in U.S. Political Ad Spending for 2024

Given the significant events that have already occurred and the many more expected leading up to the election, how will the budget for political ad spending be allocated? With increased funding for both Donald Trump and Kamala Harris, we need to step back and examine the overall distribution of funds for the 2024 political ad campaigns.

Has a U.S. Election Candidate Dropped Out Before?

Advertisers should not be surprised by Joe Biden’s withdrawal from the presidential race. This is not the first time a major candidate has exited the race close to the election. In 1972, Democratic candidate George McGovern’s running mate, Thomas F. Eagleton, withdrew and was replaced by Sargent Shriver just three months before the election. The Democratic ticket of George McGovern and Shriver lost in a landslide election defeat to Republican President Richard Nixon and Vice President Spiro Agnew.

In Kamala Harris’s case, this shift signifies a reallocation of the Democratic Party’s ad spending budget. With Election Day just over three months away, Harris faces a compressed timeline to transition the Biden-Harris campaign to focus on her candidacy. This will likely lead to a more concentrated and targeted ad spending strategy to maximize impact in the limited time available.

How Will the Democratic Party Adjust Their Campaign Strategy and Rebranding?

Under Biden, Democratic ad spending was expected to ramp up from September to October. With Harris taking over, spending is expected to increase much earlier. Harris has already raised $200 million for her campaign and is set to inherit $100 million from the Biden-Harris campaign. This rapid fundraising effort will likely result in a significant push in ad spending to rebrand and promote her candidacy.

Historical Perspective on Political Ad Spending

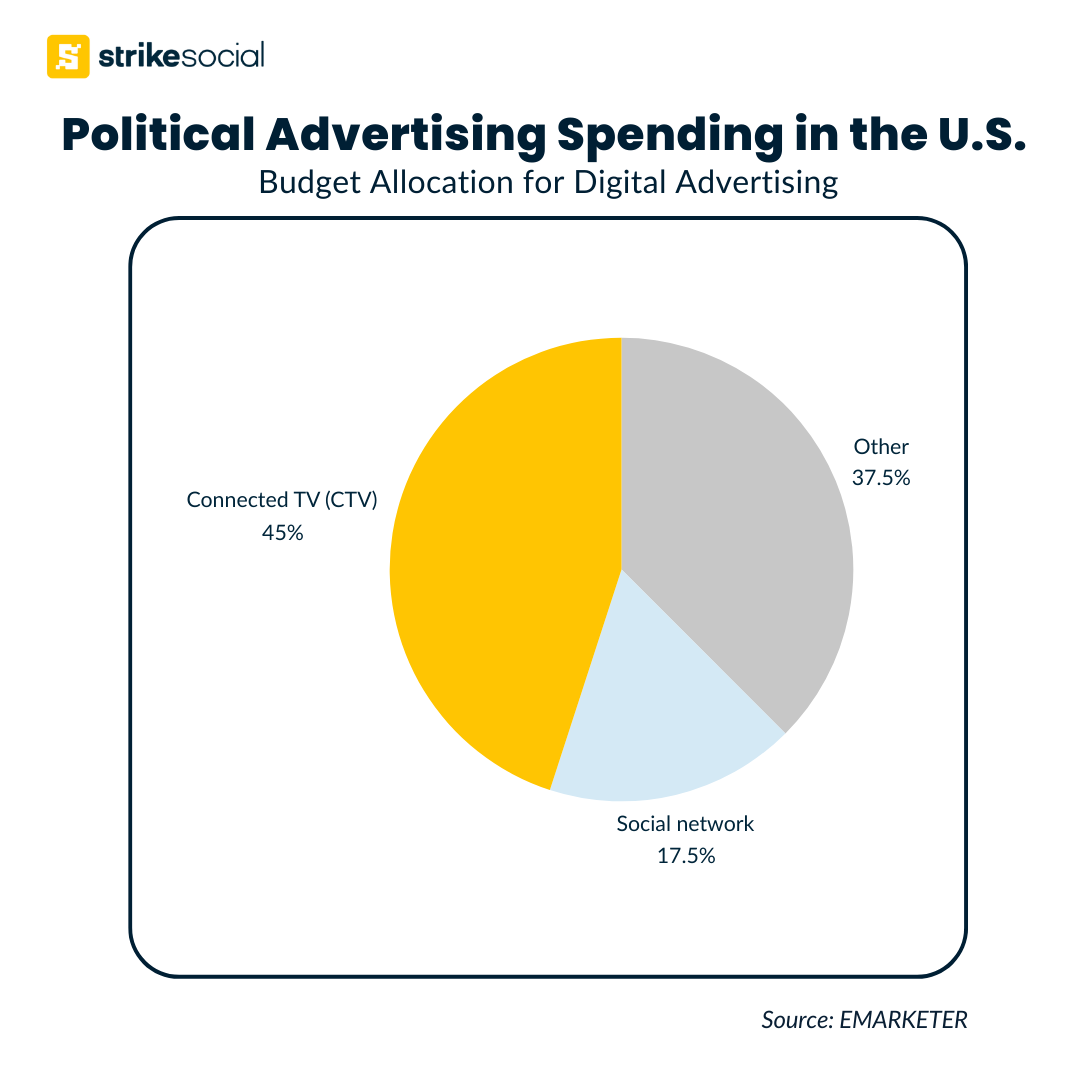

Along with traditional advertising mediums, digital advertising for political campaigns is expected to rise, accounting for 25% of total spending on presidential advertisements and other political ads.

CTV and Digital Political Advertising on the Rise

The 2024 Olympics and political ad spending are major drivers of CTV advertising’s growth this year. While broadcast and cable are still projected to receive the highest budget allocations for 2024 political ad spending, CTV is expected to account for up to 45% of the digital ad spending budget, with social media advertising at 17.5%.

Google TV and YouTube TV ads are the top destinations for increased CTV spending, primarily due to their extensive reach.

Social Media’s Role in Digital Marketing for Politicians

Despite paid social media advertising accounting for a small portion of the total political ad spending for 2024, it remains a key medium for candidates to promote themselves and their parties. Many U.S. adults are wary of using their information for political advertising and believe social media platforms should not allow such ads.

This creates limited space for political advertising on social media. However, this also presents an opportunity for those willing to navigate the restrictions, as there may be less competition in the social media ad space.

| Platform | Allowed | Allowed with restrictions | Not allowed |

|---|---|---|---|

| ✔ (authorization required) | |||

| ✔ (authorization required) | |||

| YouTube | ✔ (verification required) (with targeting restrictions) | ||

| TikTok | ✘ | ||

| X (Twitter) | ✔ | ||

| ✘ | |||

| Snapchat | ✔ | ||

| ✘ |

Further Reading

Is Pausing October Ads the Right Move as Election Season Intensifies?

As the 2024 election draws closer, ad auction costs are set to rise with the influx of political campaign ads, especially with 50% of political ad spend expected in the final 30 days before election day. Explore data and insights to assess whether advertising during this October surge in political spending is worth the investment.

What Advertisers Should Be Aware of Amidst the Surge in Digital Political Ad Spending

This information is not just for political advertising agencies; digital media buyers in general must be aware of these movements in the digital ad space to position their advertising strategies effectively. Here are the key strategies and considerations for media buyers and advertisers during the height of political ad spending on paid advertising platforms.

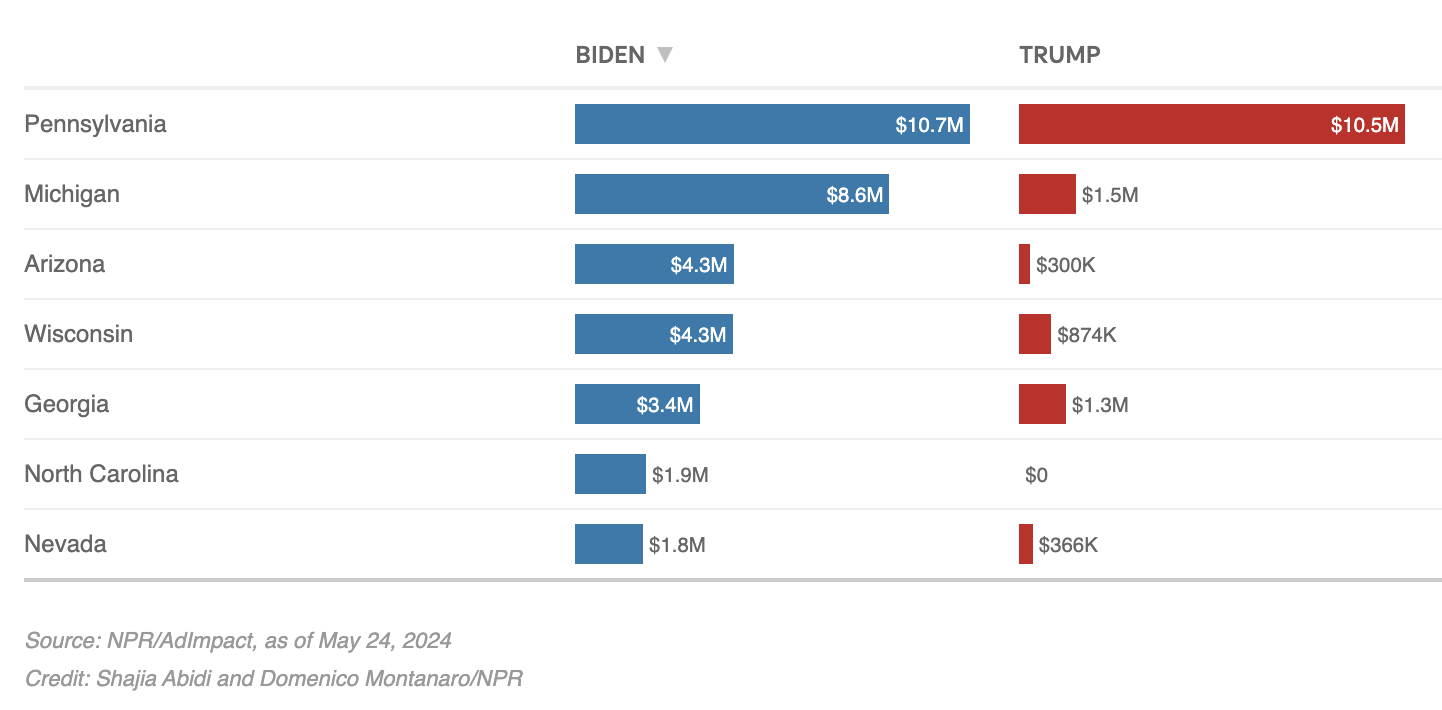

Swing States Likely to Increase Political Ad Spend

A “swing state” is a U.S. state that can likely determine or turn over the results of the presidential election, possibly due to unbridled support for one candidate or extremely high poll results leading to the election. In 2016, Trump won 7 out of 11 swing states against Hillary Clinton.

This year, six swing states are being considered:

- Arizona

- Georgia

- Michigan

- Nevada

- Pennsylvania

- Wisconsin

As of May 2024, here’s how the ad spend for these states has been going:

The Democratic Party, led by Kamala Harris, has taken an early lead with plans to invest $50 million in political advertising across six key states. Meanwhile, MAGA Inc., a pro-Trump group, is set to spend $32 million on negative campaign ads targeting Harris’ record as a prosecutor. These attacks will begin in her home states of Pennsylvania, Georgia, Nevada, and Arizona.

As Harris’ poll numbers rise among Pennsylvania voters, the competition for ad spend in this state is expected to intensify.

What This Means for Media Buyers:

Geo-targeting-wise, the impact of political campaigns on your brand’s existing campaigns can drive CPM rates higher, especially leading up to the election peak periods.

If budget is an issue, nationwide brands can focus ad spending on non-swing states, where the competition will be lighter on the political ad side and similar to non-political periods.

Here are our CPM projections on how political ad spending will affect CTV advertising costs in the months leading to the 2024 US presidential election:

As shown above, CPM costs are projected to rise from September to October due to heightened political ad spending. Traditionally, October is a peak month for efficiency in Q4, but the surge in political advertising is expected to drive up costs during this period.

CPM costs are anticipated to decline in November, particularly in the final week before Election Day. This decrease is attributed to platforms like Meta instituting bans on political ads during the final week of the campaign and after the polls close, possibly lowering CPM costs at that time.

Quick tip to optimize ad spending:

When running a long-term campaign, utilize always-on advertising.

If you’re concerned about overspending, there’s no need to turn off your ads during the election period. Instead, reduce budgets and spending during this campaign duration for consistent performance, focusing on your top-performing ads and campaigns.

When the election period winds down, likely around November, you can increase your auction buys to get that extra push. You can achieve your desired results with proper campaign pacing while maintaining efficiency.

Capitalize on Targeting Strategies Restricted for Political Ad Campaigns

Depending on the social media advertising platform, several restrictions are imposed to balance advertising policies and the safety of user information. Regular paid advertising campaigns already have an edge against political advertising, as the latter faces multiple restrictions on audience targeting.

What This Means for Media Buyers:

For example, U.S. political campaign ads on Google and YouTube can only use the following targeting methods:

- Geographic location (except radius around a location)

- Age, gender

- Contextual targeting options such as ad placements, topics, keywords against sites, apps, pages, and videos

Thus, media buying teams should focus their ad spend on campaigns directed towards other targeting strategies such as:

- Interest targeting

- Household income

- Custom audience and segments

- Custom search terms

- First-party data such as website visitors, customer lists, etc.

Video Advertising on YouTube and CTV Will Be Maximized

CTV advertising for political ads received a huge leap from just 19% of the digital ad spend budget allocation in 2020, primarily because it provides a more targeted, personalized ad experience. Additionally, the completion rate for CTV ads can reach up to 96%, making it an excellent medium for ensuring video ads are fully viewed by audiences.

As competition for video ad placements increases on YouTube, YouTube TV, Google TV, and Connected TV, advertisers must adapt to maximize their media buys during the height of the 2024 political ad spending.

Strike Social has demonstrated the efficiency of CTV in YouTube campaigns, proving it to be the most effective medium even when compared to mobile platforms.

What This Means for Media Buyers:

CTV ad inventory is vast, including not only Google TV and YouTube TV but also major streaming apps like Pluto TV, Hulu, Crackle, and Netflix, along with CTV app devices like Roku, Chromecast, Firestick, Apple TV, and other connected devices.

If you haven’t expanded to CTV advertising yet, especially in YouTube campaigns, know how you can do so to broaden your reach and achieve increased efficiency.

Managing Your Ad Spending During the Political Campaign Season

The 2024 political ad spending surge is inevitable, and so is the increase in digital ad space spending. Brands and advertisers must be ready to adjust and adapt to the changing dynamics of the U.S. elections during this period.

While increased budgets and spending are projected, they can be managed effectively with the right media planning and support from a reliable social media advertising agency.

Contact our team today for a personalized walkthrough and see how Strike Social’s technology can help you achieve your desired results at efficient costs.