Strike Overview

- Christmas advertising costs are expected to intensify as demand surges throughout the fourth quarter. We break down how holiday auctions, rising CPMs, CPCs, and CPVs, and shifting consumer behavior impact your budgets from October through Christmas Day.

- Learn how to pace ad spending across the holiday advertising season and plan out for last-minute shoppers leading into Super Saturday and Christmas Day.

- See how to execute profitable Christmas ad campaigns with a Q4 strategy designed to protect margins while unlocking stronger revenue across the full holiday cycle.

Jump to Section

Christmas Advertising Costs: How Major Holidays Impact Your Q4 Ad Spend

Christmas advertising costs climb higher than at any other point in the year, and without a strategic approach, they can spend your Q4 budgets fast. The objective is not just to manage the volatility of increased competition, but to navigate the run-up to Christmas Day where visibility is of utmost importance.

You need to be present when consumer demand peaks, but you also need to protect your profitability by strategically shifting spend away from the least efficient windows. That’s where the Q4 strategy comes in; push hard on efficient periods to fund the aggressive, high-converting campaigns you’ll need during peak days.

How Q4 Ad Auctions Drive Christmas Advertising Costs

Christmas advertising costs surge every Q4 because ad inventory stays fixed while demand skyrockets. Every brand fights for the same impressions, and that pressure pushes CPMs, CPVs, and CPCs sharply upward across platforms. Unless your conversion rate climbs at the same pace, your margins compress fast.

Q4 becomes a bidding war, and every week closer to Christmas Eve and Christmas Day, the peak holiday shopping window becomes more expensive. Holiday advertising is especially aggressive as more brands shift spend into paid social to capture last-minute online shoppers.

Average Costs During the Christmas Advertising Season

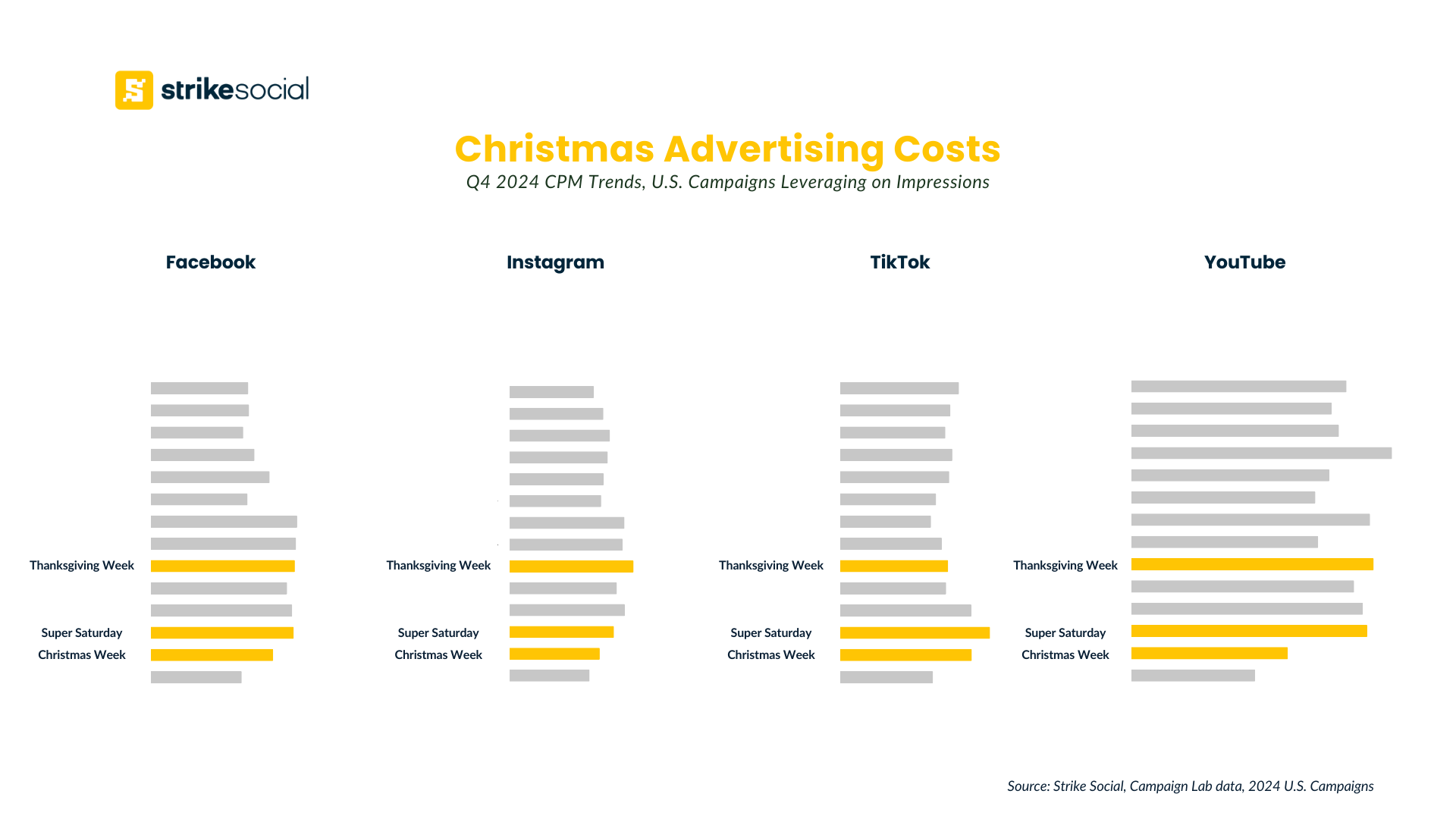

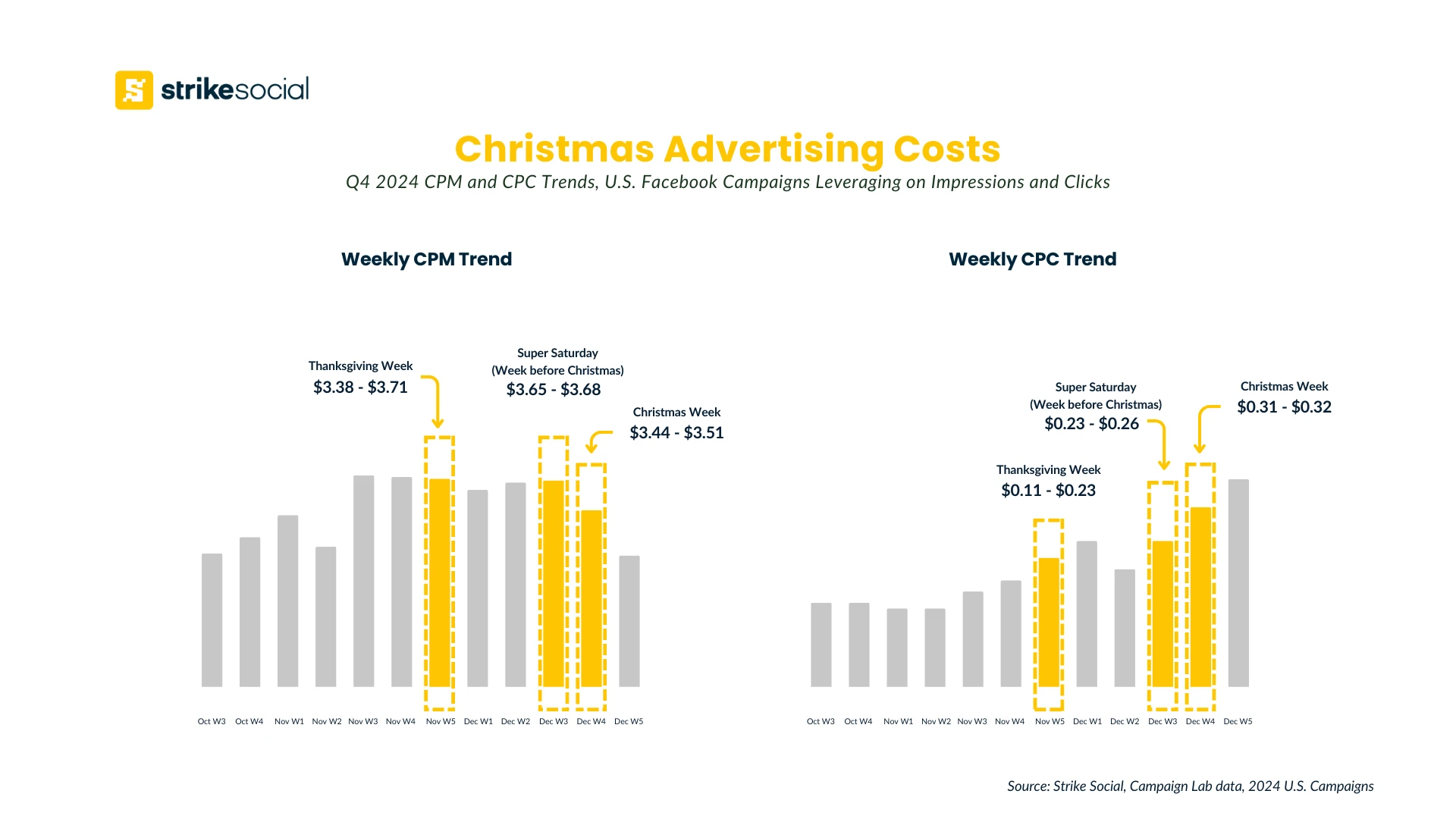

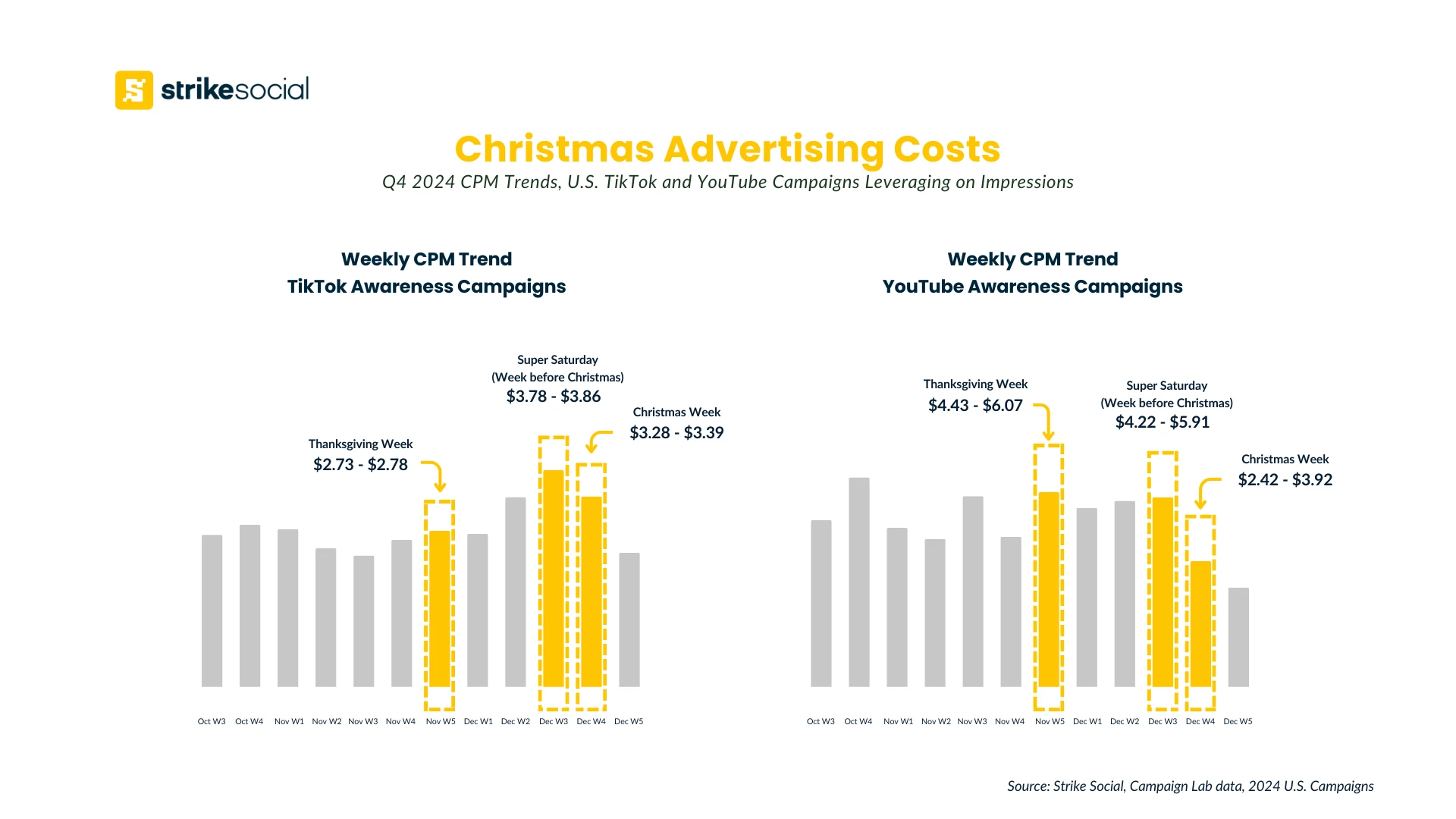

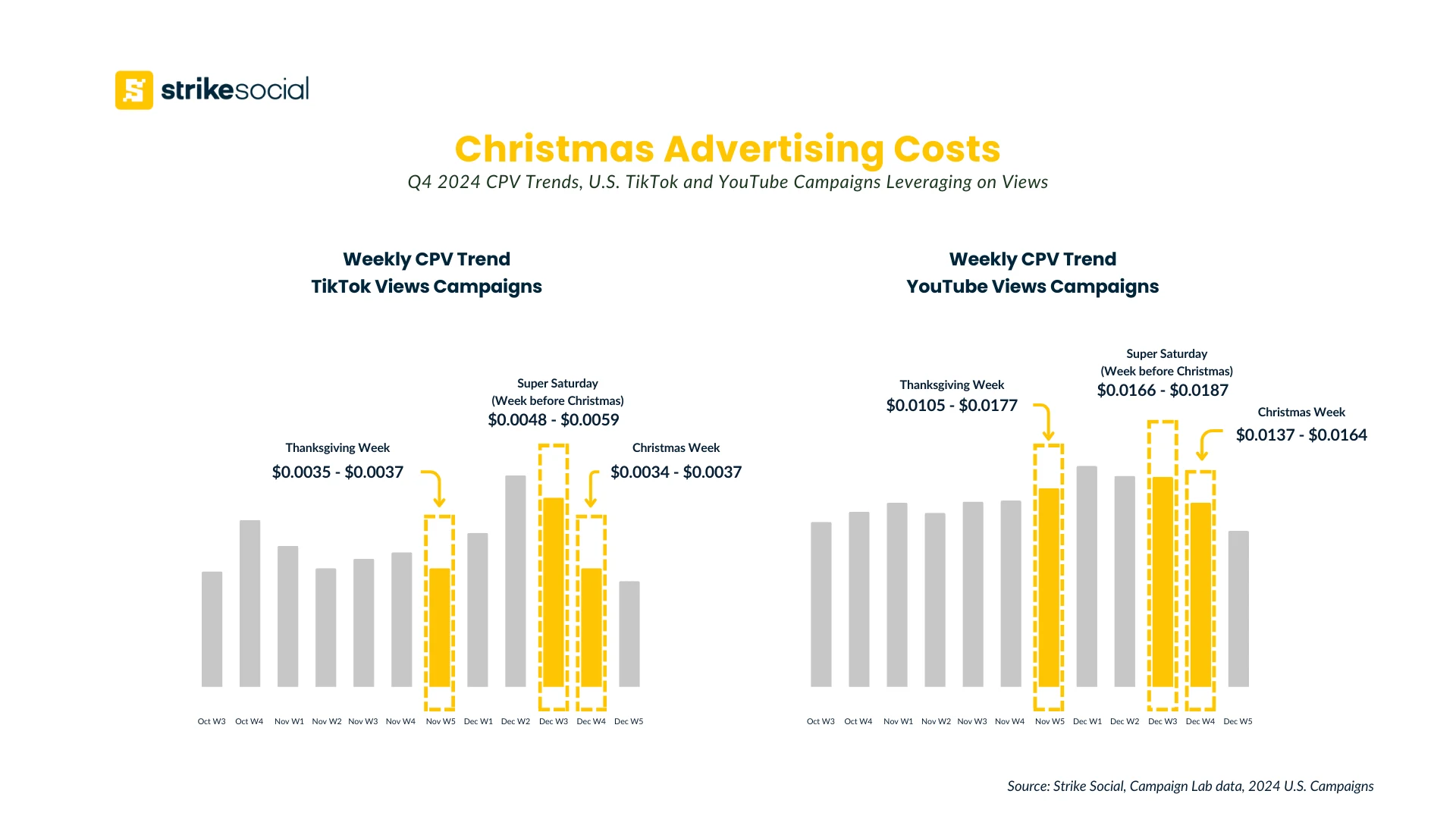

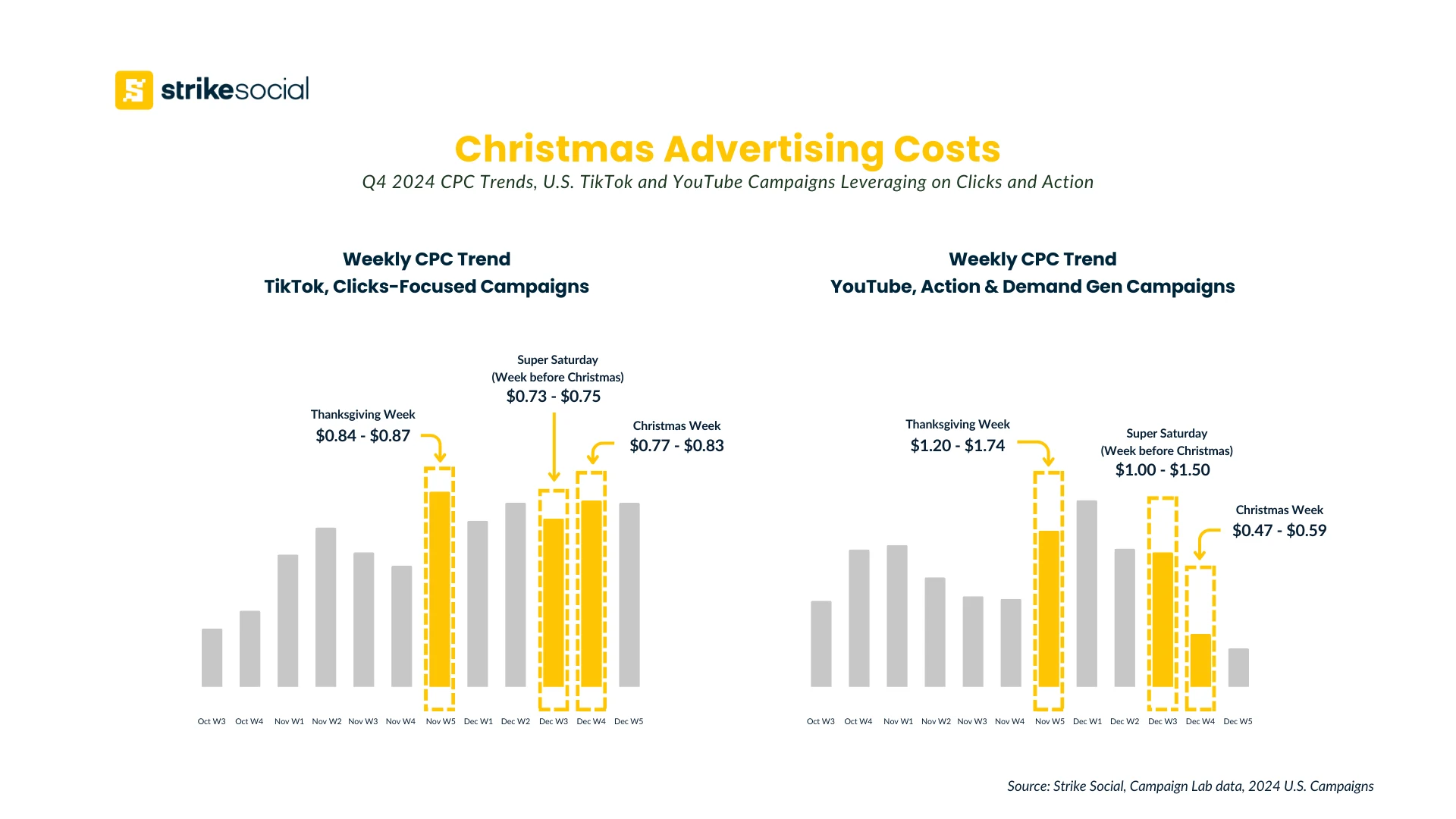

Across platforms, data shows the same pattern: costs begin rising in late November and peak between the first three weeks of December. CPMs increase just before Thanksgiving, climb through Super Saturday week, and stay elevated until the final shipping cutoffs.

CPM Trends

Key Insights:

- To efficiently capture impressions during Thanksgiving and Christmas on Meta platforms, maximize the early weeks of October for reach campaigns. Given the sustained plateau of high Instagram and Facebook ad costs during November and December, it is advisable to shift Q4 budgets toward lower-funnel campaigns designed to better secure sales.

- While all platforms see increased costs, TikTok sees its most aggressive CPM peak during Super Saturday. This reflects the platform’s role as a driver of viral, last-minute gift inspiration. If you are running brand awareness on TikTok, efficiency requires launching before this mid-December spike.

- YouTube sees a significant increase in viewership during Thanksgiving Week, and even starting in October, due to the holiday break. This spike is followed by a noticeable drop-off in the lead-up to Christmas Week. This dip in viewership presents an opportunity for advertisers on YouTube to achieve greater efficiency, as other platforms maintain their peak pricing.

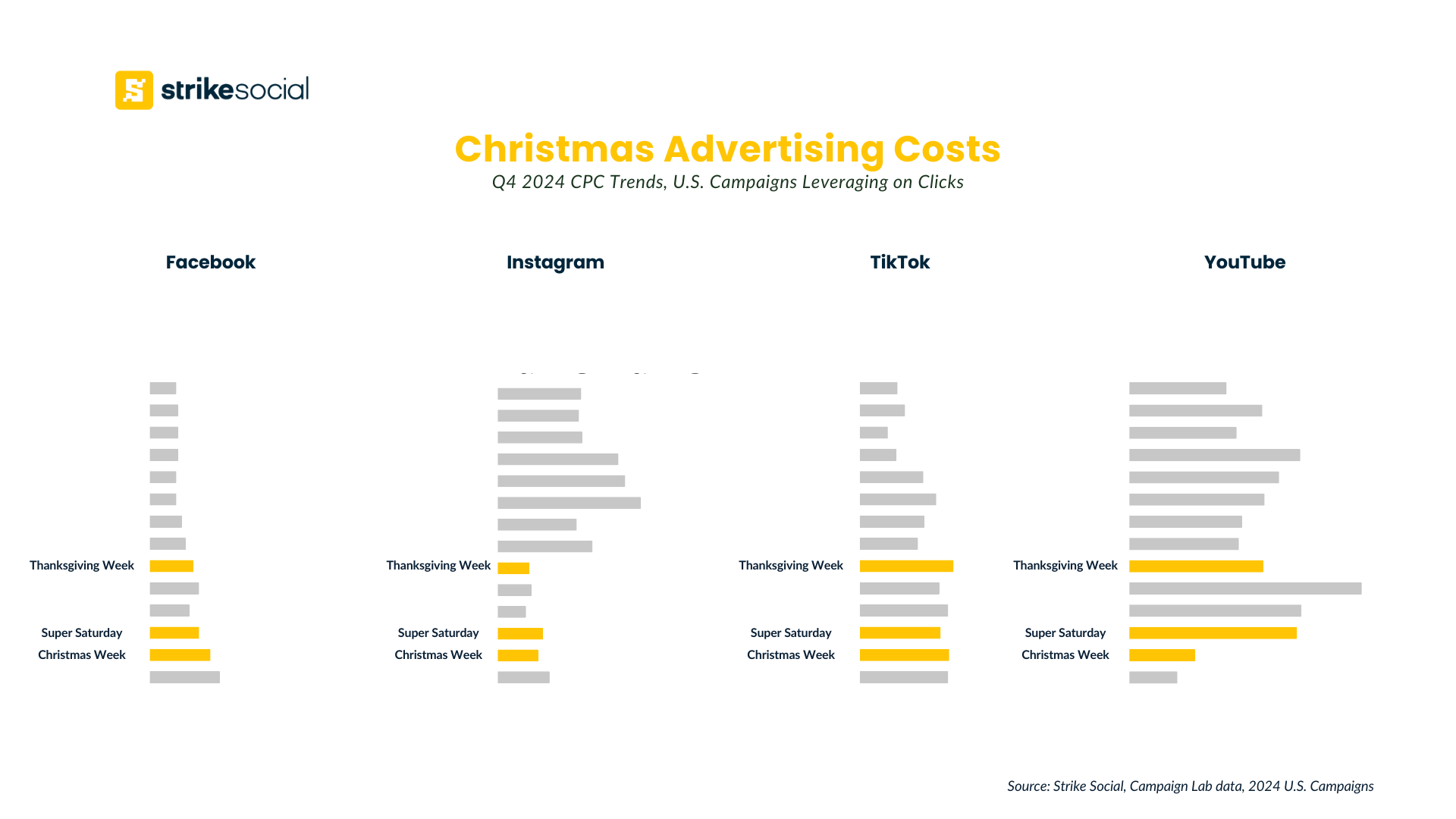

CPC Trends

Key Insights:

- Notice that on Facebook, CPCs continue to rise and actually peak during Christmas Week. This suggests that while users are still active, they are fatigued or less likely to click off-platform as the holiday approaches, driving up the cost of traffic exactly when shipping cutoffs are imminent.

- YouTube CPCs for Demand Gen campaigns reach their highest point immediately following Thanksgiving. They then decline, which is ideal for advertisers targeting last-minute shoppers. YouTube ads experience a significant drop during Christmas Week, making it a good time to pursue final stock sales before 2025 ends.

- The gap in CPC and CPM trends suggests a need for broader platform diversification. This is particularly noticeable on Meta platforms, where Instagram’s ad costs remain relatively modest post-Halloween, while Facebook’s show a slight increase. Despite this, both platforms demonstrate increasing efficiency later in Q4.

Further Reading

How Influencer Content Powers Holiday Momentum from Halloween to Q4

Influencer-led Halloween campaigns help brands build early traction before the biggest retail events of the year. With October acting as the ramp-up to Thanksgiving and major Q4 holidays, creator content drives engagement and primes audiences for stronger conversion performance later in the season.

Why the Last-Minute Rush Demands Different Tactics

The most expensive days of the year fall within the 7–10 days before Christmas Eve, when shipping windows are closed, and consumers shift to:

- digital gift cards

- in-store pickup

- last-minute Super Saturday deals

- hyperlocal shopping decisions

This rush inflates Christmas advertising costs to their absolute peak. But conversion rates often drop because:

- intent becomes fragmented

- cold audiences stop converting

- last-minute shoppers move fast and comparison-shop across platforms

If you’re running heavy prospecting during this window, you’re paying premium auction prices for lower-intent traffic, making it the most inefficient time to introduce new users into the funnel.

The Solution: Strategic Spend Pacing

Your Christmas ad campaign should prioritize precision pacing, not volume:

- Spend aggressively when ads are still efficiently driving impressions, views, and clicks.

- Pull back when Christmas advertising costs spike and competition surges.

- Shift budget from mid-December spikes into more stable early-season weeks.

This approach is the foundation of the Q4 ad auction strategy, ensuring your 2025 holiday advertising budgets are allocated to the windows that actually deliver profit.

When to Scale Spend for Holiday Conversions

To scale holiday spend efficiently and avoid overspending during the most expensive days of the year, you need a phased strategy that spreads risk, builds high-value audiences early, and reserves budget for the best conversion windows. This can help you manage Christmas advertising costs more effectively while maximizing revenue throughout the entire Q4 timeline.

October to Early November: Low-Cost Conversion Opportunities

From Strike Social’s Halloween and Thanksgiving trends, Halloween week through early November consistently delivers the lowest ad costs of Q4.

- Halloween week shows 15–34% lower ad costs compared to Black Friday through Cyber Monday.

- For Facebook clicks and link-click campaigns, lower-funnel optimization is 46% more efficient in this early window compared to mid-December.

- Action: Launch diverse Christmas social media campaign ideas focused on high-value lead generation, shopping catalog clicks, and product views. This builds a massive retargeting pool you can further convert later.

- Why It Works: By warming audiences early, when CPMs and CPCs are still low, you’re building a retargeting pool that converts far more efficiently once Christmas advertising costs spike later in Q4. This reduces overall customer acquisition costs and gives your brand a stronger advantage when the real shopping rush begins.

Thanksgiving to Cyber Monday: Scaling on High-Intent Audiences

This period remains one of the strongest windows for conversion campaigns, but also one of the most strategic. You should scale only if your high-intent audiences are performing at or above your ROI and ROAS threshold.

For your 2025 holiday advertising, platform behavior shows:

- On TikTok, CPMs remain comparatively efficient, making it a strong period to capture upper- and mid-funnel attention from shoppers who may not yet be familiar with your brand.

- On YouTube, Reach campaigns perform well during the pre-Christmas advertising period, before major retailers take over premium placements during the Christmas week.

- Action: Shift your budgets to retargeting and lookalike audiences based on high-intent actions (e.g., “Add to Cart,” “Viewed Specific Product”). Deploy your high-converting Christmas ad campaign creatives at this time.

- Keep in Mind: Only escalate spend here when your ROAS is healthy. If your goal is to raise awareness before Christmas to prepare for lower-funnel campaigns in December, this is a powerful window. But if you’re looking to boost awareness for a Q5 push (post-Christmas/January), scaling here without tight optimization can expose you to unplanned increases in Christmas advertising costs.

Early December to Super Saturday: Chase Last-Minute Conversions

This is where ad spending discipline becomes critical. The weeks leading into Super Saturday 2025 represent the final, high-intent window for both online and in-store Christmas shopping—but also one of the most volatile periods for Christmas advertising costs.

You need the right balance: overspend too early, and you’ll miss last-minute conversions; reserve too much budget, and you’ll pay high TikTok and YouTube ad costs.

Across these platforms, Strike Social data shows:

- Views-focused campaigns (CPV) become increasingly cost-efficient from early December through Super Saturday.

- Action campaigns (CPC) rise around Thanksgiving and early December but often stabilize before Christmas Day, making this a strong period for final conversions.

- Focus: Emphasize urgency to drive conversions by using “missing out” language, such as “few stocks left” or “limited stocks only.” To secure immediate purchases, heavily promote quick-delivery options, such as digital products (gift cards, subscriptions) and convenient click-and-collect services.

- Execution: For campaigns active on Christmas Eve and Christmas Day, the copy must convey an extreme sense of urgency. Implement manually capped budgets and target highly narrow, high-intent audiences. Focus on users who have searched for last-minute Christmas presents or shown strong conversion signals (e.g., users who visited the gift card page but did not complete a purchase).

Executing High-Converting Christmas Ad Campaigns

Winning Christmas ad campaigns requires more than strong creative; you need tight control over bidding, frequency, audience pacing, and auction behavior. This is where brands either scale profitably or see their Christmas advertising costs spiral.

Below are the execution strategies that maintain steady performance, even during the most expensive weeks of the year.

Strong Creatives that Make Their Mark

Your Christmas ad must break from the sea of red, green, snowflakes, and generic “holiday sale” creative that floods feeds during December. Strong creatives are the most reliable way to hold CPCs, CPVs, and CPMs down when auction pressure surges.

- Lead with Urgency & Value

- Use clear, conversion-driven messages tied to timely deadlines:

- “Last chance for Super Saturday delivery,”

- “Final inventory clearance before Christmas Day,”

- “Few stocks left—order now.”

- These trigger immediate action and align with last-minute holiday buying behavior.

- Use clear, conversion-driven messages tied to timely deadlines:

- Test Early Before Costs Peak

- Use October and early November to test multiple Christmas social media campaign ideas.

- Validate formats, angles, value props, and hooks while CPMs are still low. What wins here will carry your campaigns through the most competitive weeks.

- Differentiate Visually

- Avoid generic holiday tropes. Choose a creative that stands out in color, pacing, composition, or product framing.

- Anything that resembles a standard holiday ad will likely lose attention and lead to wasted impressions and spend.

When to Use Target ROAS vs. Max Conversions

Smart bidding is one of the most powerful levers you have for controlling Christmas advertising costs. However, each bidding model plays a distinct role depending on the phase of Q4.

| Holiday Advertising Season | Campaign Window | Strategy |

|---|---|---|

| Late November through Super Saturday | Peak Conversion | Use Target ROAS.This tells the platform to pursue only conversions that meet your ROAS benchmarks, which is critical when CPCs and CPMs spike and auction volatility increases. Target ROAS protects your margins and prevents wasted spend when cost surges. |

| October–Early November Post-Christmas | Foundation & Q5 Phases | Use Max Conversions or volume-based bidding. This helps you flood your funnel with lower-cost traffic, collect high-value signals, and expand audiences while the auction is still efficient. You’re buying efficiency and volume early so you can buy profitably later. |

Managing Christmas Ad Frequency

During the Christmas advertising season, frequency becomes one of the most overlooked yet most expensive levers.

High frequency in a high-cost environment leads to:

- creative fatigue

- rising CPCs and decreasing CTR

Here’s how you can manage frequency effectively:

- Use frequency caps on retargeting, especially during the final 7–10 days before Christmas Eve.

- Prioritize audience rotation to keep ads fresh as costs rise.

- Refresh the creative weekly in December to prevent performance decline.

Proper frequency control ensures you reach the maximum number of eligible shoppers without burning budget on impressions that no longer drive incremental conversions.

Turn Your 2025 Holiday Advertising Into Your Most Profitable Season Yet

Christmas advertising costs in 2025 will be among the most competitive this year, but they also represent one of the strongest opportunities for scalable growth. The brands that win aren’t the ones who push spend blindly; they’re the ones who treat Q4 as a profitability window.

By adopting a more strategic approach: optimizing the Q4 Strategy, securing efficient ad impressions and clicks early on, and maximizing efficiency during the Q5 dip, you can manage your Q4 ad spend with confidence. In return, expect stronger returns, healthier margins, and a Christmas advertising plan built for long-term performance.

Article by

Lee Baler, Strike Social’s VP of Sales & Strategy

Lee leads global strategy, helping clients and agencies maximize YouTube and paid social performance. Constantly tracking industry trends, he translates insights into strategies that help brands stay competitive and achieve sustained profitability.