The Upfronts are 6 weeks away. I keep asking Alexa and Google variations of the same question

It goes something like this: Alexa, where is all this new 2021 ConnectedTV Ad Supply going to come from?

Our teams work in the digital auctions so we think a lot about supply. Here are some CTV numbers w/ sources at the bottom of the article.

CTV and Ad Supply Explained

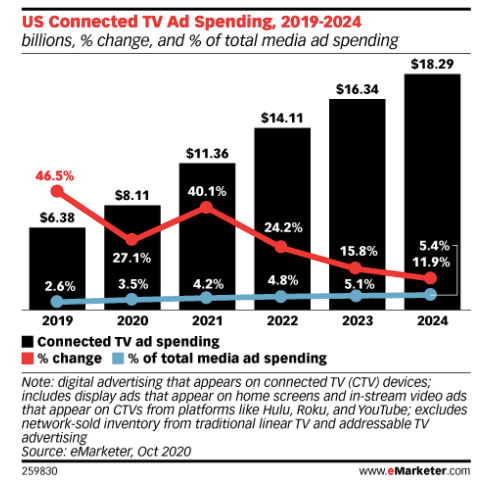

- CTV 2021 spending is projected to rise 40.1% to $11.3B in the US alone. This does exclude network sold inventory. (1)

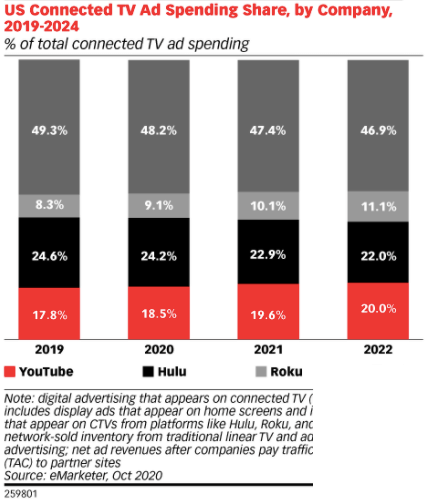

- Net revenues from YouTube, Hulu, and Roku collectively account for about half of all CTV ad revenues (2)

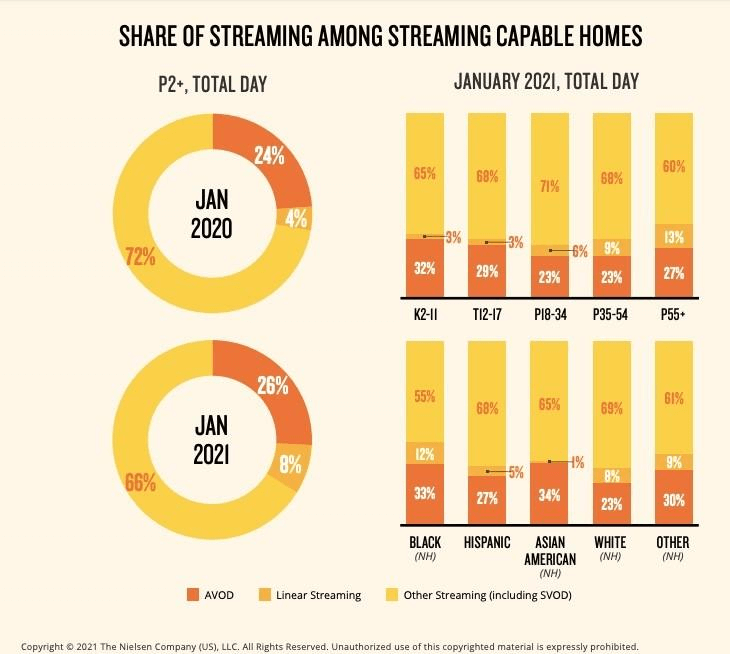

- Per Nielsen, in January 2021 Subscription Video on Demand (SVOD) services were 66% of all streaming time. SVODs of course have no ad placements. (3)

- In the same Nielsen report looking at January 2021 data, Ad Supported Video on Demand is only 26% of all streaming video time. This is up from 24% in Jan 2020 so an 8% gain but still only 24%

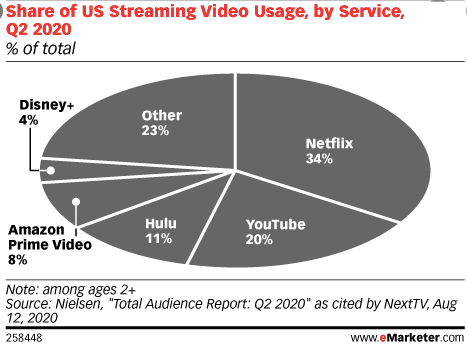

- Included in those SVOD’s is of course Netflix. In August of 2020 Netflix was 34% of all streaming video usage. Netflix grew 21% in US subscribers from Q4 2019 to Q4 2020. Amazon Prime has 126M US members… all with access to Prime Video Disney+ has 40MM US subscribers (100MM global) Apple TV+ lists 40MM subscribers overall w many of those on a free year subscription (4)

- Other streaming, including some SVOD, make up the other 8% of share

- Most TV Upfronts are still planned for May. Everything out there says, “There will be a greater focus on cross platform, the selling of ads on linear TV combined with streaming video Makes total sense. TV Ratings are down so they need to make up revenue through all their platforms (5)

The 26% of Streaming Time in Ad Supported Video On Demand (AVOD)

Let’s focus on that 26% of Streaming Time in AVOD. What’s the composition of that 26%? It’s really hard to find out. I keep asking Alexa and Google. I’ve gone through reports. I’ve read through TTDs and Magnite’s earnings. I believe it’s intentionally vague. Or the financial community isn’t sure but the numbers are going up and it’s a positive story to tell.

This is the best I’ve got:

- YouTube is 20% of all Streaming Video and we know at Strike, CTV is about 40-45% of a given view based campaign. If Netflix is 34% of all streaming video and SVOD is 66% let’s use the same rough 2:1 multiple. We’ll assume YouTube is 40% of all AVOD. This probably does not include YouTube TV inventory which is the cable replacement. Some of that inventory is making its way into YouTube Open Auction even though Google says it’s not. (6)

- Hulu is 23% of AVOD Revenue but only 11% of AVOD Supply. Hulu is a great product and they have developed innovative ad units but those rations are out of whack. No platform should command 2:1 revenue to time spent. Even with the investments Disney is making on content like the NHL this seems unsustainable. More on that in a second.

- Roku ‘sees’ 49% of all CTV/ OTT ads through their devices. Roku is super interesting because they’re seeing a ton of inventory and they have the Roku Channel. They can add new content to this channel inexpensive and make a lot more CTV Supply.

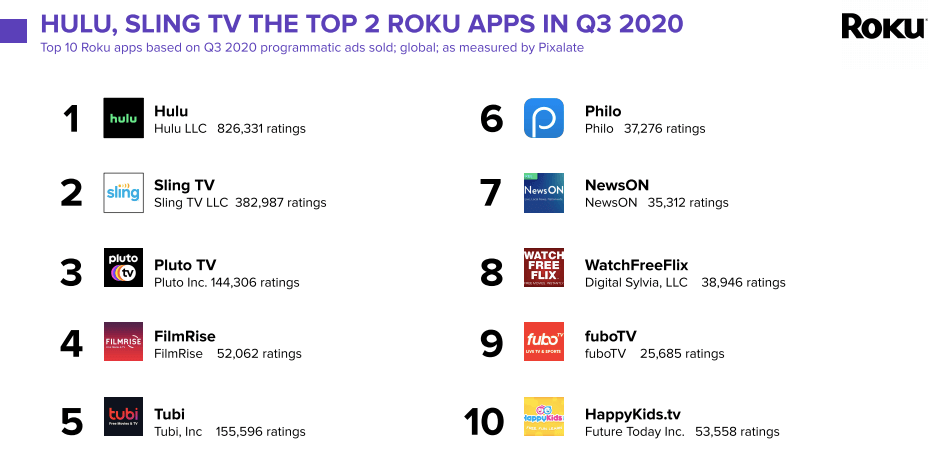

- Below are the top apps being downloaded through Roku. It’s Hulu, SlingTV which you can watch through your Roku stick and then all the free syndicated content gang like Pluto, Tubi, Film Rise, Philo, etc. This is the AVOD long tail and a gaining piece of that 26% AVOD supply that’s not named YouTube. (8)

- I’ve left off TheTradeDesk. This is where I’m missing a trick. Yes they have First Look deals and they take the friction out of buying but this Upfront Season will be telling. Publishers need to sell more streaming and CTV to make up for revenues they won’t receive in traditional Linear Upfront Deals. Won’t these publishers be looking to maintain as much of that revenue as possible without it going to tech fees? Yes buyers will want to transact programmatically and there’s more spend & revenue going through CTV pipes but the publishers, who own the CTV supply, are going to sell more of this inventory direct to the buyers. This should have the effect of driving down margins for the DSPs.

Who Can Create CTV Supply

Disney announced deals with the NHL where they’re going to have over 1,000 games on ESPN+ and Hulu. This is a lot of hours of content but it’s believed to be $400MM annually. This is a premium product and it should help boost ESPN+ Subs but this is a lot to invest to create more AVOD Supply for Disney/ Hulu. (9)

Google doesn’t need to spend lavishly to create CTV Supply.

Google has YouTube. And yes YouTube pays their content creators and publishers but they can create terrabytes of AVOD content for CTV at a fraction of that cost.

Roku doesn’t need to spend lavishly to create CTV Supply.

Roku is seeing more CTV Inventory and they can add more cheap content to the Roku Channel. It’s all there for them.

DSPs, like The TradeDesk, are dependent upon content creators giving them access. I wouldn’t be surprised to see TTD and their suddenly volatile stock price build or buy more ‘TradeDesk Channels’ to compete with the Roku Channel. They need to find more cheap CTV supply to meet the auction demand. The publishers are raising the floor.

There’s some natural CTV growth in Int’l for sure. We believe there’s going to be a lot of acronyms flying around and people trying to capitalize on the CTV bull market without actually understanding the supply.

3 Key Takeaways

- AVOD is 26% of all Streaming. Monetizable CTV inventory is not infinite

- A couple of platforms, specifically Roku and Google/ YouTube can manufacture new CTV Supply far more cost efficiently than any other provider

- Price and Performance matter on CTV as well. Understanding the costs of the supply and what real reach and frequency looks like in CTV is core to building an efficient plan.