This year, US consumers are filling their Christmas carts ahead of the holiday shopping frenzy, which could end the holiday advertising rush in the auction this fourth quarter. While the first half of 2022 began with high hopes for business economic recovery, closing this year was an uphill battle for most industries forcing companies to shrink their ad spends during the holiday season. Regardless of the financial downturn, looming recession, and inventory disruptions, US households are still on track in spending to spread cheers this holiday season.

Unpack the Joys of Advertising this Holiday Season

According to the NRF September consumer survey, six of ten winter holiday shoppers still value holiday celebrations and gift giving. However, this year’s shopping habits are different as consumers continue to tighten their belts. US Shoppers are tweaking their spending habits to supplement their income by buying during the pre-holiday promotion ahead of Cyber Five, cutting back on their Christmas lists, or staying loyal to familiar brands and less gift exploration.

How will lackluster digital media growth impacts social campaigns as the peak season approaches?

Related article: YouTube Holiday Advertising: A Gift to Marketers

Will The Decline In Media Investment Cancel Advertisers’ Holidays?

Ad spending continues to trend downward in its fourth month, down 5% year-over-year, according to the September 2022 Standard Media Index Core Data report. Additionally, Q3 2022 saw a lag in digital media investments, growing only 5% compared to 24% in Q1 and 10% in Q2. Travel and pharmaceuticals were the industries with the most growth in digital advertising efforts—a +30% and +12% YoY uptick over last year. Most businesses decided to cut back their ad allotment outside the two verticals mentioned. Companies in wellness, technology, financial services, and general business experienced the steepest declines.

US consumers continue to hear holiday melodies rather than the noise surrounding probable recession. NRF President and CEO Matthew Shay mentioned, “While consumers are feeling the pressure of inflation and higher prices, and while there is continued stratification with consumer spending and behavior among households at different income levels, consumers remain resilient and continue to engage in commerce.”

This year’s year-end retail sales forecast will be half as bright as last year’s. NRF expects a 6% to 8% combined retail sales this November and December, far below last year’s 13.5% holiday retail sales growth.

Advertisers should focus on consumer optimism heading into the holiday season, regardless of ad revenue slips on Meta and YouTube. Advertisers should focus on consumer optimism heading into the holiday season, regardless of ad revenue slips on Meta and YouTube.

Related article: With Stores Re-opening, YouTube Holiday Shoppers Watch Time Continue To Rise

Advertisers’ Opportunity to Capitalize on Holiday Shopping Behavior Shift

The economic disruption two years ago is still in full effect, and shoppers seem to be embracing the change. Advertisers anticipate the last two months of the year as the most challenging season in the paid social auction. Now that some consumers have started crossing their shopping lists even before the famous Black Friday sale, advertiser spreads their promotional efforts across the fourth quarter.

Consumers’ reaction to elevated inflation varies by buying power. Shoppers categorized below $50,000 annual earnings prefer to shop online. Their top priorities are finding the best shopping deals, cutting costs to travel to stores, or bulk shopping to remove delivery fees. Conversely, affluent buyers are taking the hit from the price hike but will continue spending on gifts and celebrations.

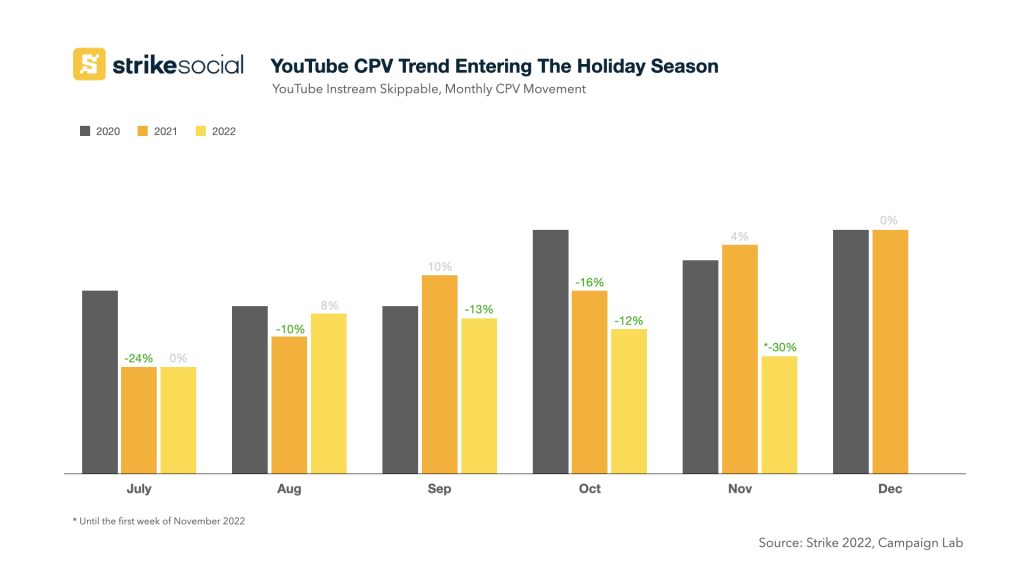

As the team looked into last year’s YouTube CPV trend using TrueView Instream Skippable, we discovered that the ad marketplace was busier during the early weeks of October. Like last year’s trend, the brand’s online promotional effort started in September and early October. Consumers have been following big retail stores’ early kickoff on Holiday deals weeks ahead of the shopping months.

Another factor that can move funds outside of digital advertising is that retail stores are once again building in-store customer experiences for those choosing to shop in-store rather than in digital storefronts. Even as mallgoers found joy once more in traditional shopping, 81% of retail shoppers check their mobile phones for product reviews and feedback before making a purchase. At the same time, Millennial digital catalog swipers will continue to spend more time on their devices, emptying their online shopping carts while at work during weekdays.

Consumer optimism ahead of the holiday season will continue to outweigh the challenges of changing buying behavior. Advertisers can find success by putting more value on their holiday campaign’s longevity to capture loyalty from their audiences. By setting up an always-on campaign, brands can meet shoppers of any kind anytime or anywhere on their buying journey.

Related article: 3 Reasons Why Always-On Video Advertising Strategy Fits Well in Alcohol Brands

Holiday Will Remain Festive For Advertisers

Advertisers must not only wear their creative hats but should find the balance between an economic downturn and the rise in time spent on screen and social media. Numerous factors will affect ad effectiveness, but media teams who are always on their toes can navigate themselves to sustain promotional efficiencies. Combining always-on and drumbeat campaigns allows media buyers to enhance engagement, build brand loyalty, and drive sales.