The 2020 pandemic fast-tracked the already growing CTV and digital advertising industry. While the adoption of video streaming is accelerating, traditional TV subscribers such as cable or satellite are in a steep decline, losing 6.2 million customers in 2020. As 73% of the adult internet users in the U.S. said that the price is too steep to keep their subscription, this paved the way for connected TV to be the best place viewers can consume video content.

As new users flock to streaming platforms that support ads, advertisers increase upfront CTV Video ad spending by almost 50% this year. Jumping to $4.51 billion from $3.02 of last year, and there seems no sign of slowing down. Moreover, as media companies expand globally, there will be more streaming platforms and services in the future.

Marketers have pitfalls to maneuver in this expanding industry. Privacy policies may limit tracking; the use of 1st party data has been limited and perhaps the most noticeable for the industry. Besides targeting concerns, buyers are expecting to have an interesting Q4. As digital video deals have been on the rise, it will create a lack of easily accessible CTV supply for advertisers.

Challenges in Growth

Scaling

Coming into the upfront season, many marketers made or were looking to make CTV upfront commitments to secure inventory. Early data shows that even with these commitments and attempts to control max CPM’s, the frequency when marketers select individual channels and networks is 7-8x.

More than $4.5B was committed to connected TV (CTV) advertising in the TV Upfronts – an unprecedented sum that continues to grow. Yet, per Frank Sgrizzi’s piece, “if you have watched an ad-supported video recently, you have likely experienced the maddening repetition of a small number of ads.”

Marketers have constantly been challenged in making non-subjective decisions regarding media buying / choosing specific publisher partners vs. efficiency. Scaling CTV campaigns often ties the hands of marketers due to the current audience size and available inventory. In a previous post, we outlined visibility in the CTV supply. Publishers are charging a premium because of the demand and the loss of linear eyeballs.

Measurement

Since CTV is a new advertising channel, marketers are scrambling to look for metric standardization, consolidated reporting, and inventory sources across different CTV campaigns. In addition, new OTT providers and OEMs will continue to produce platforms together with the rise in the CTV demand, making measurement more fragmented.

An article in tvtechnology.com shows that 58% see inconsistent measurement as the number one obstacle in CTV advertising. For advertisers to fully understand and measure their ad performance, working with third-party partners or ad tech companies helps them bridge the gap in the CTV ecosystem.

Connected TV Costs Are High

CTV offers the highest Video Completion Rate across all video advertising channels, but this advantage comes with a considerable amount. Comparing the different platforms, the CTV average CPM is at $23-$36, while the average YouTube Ads CPM is $3.53, and Cable TV is at $19.

The underlying premise of high CTV ad cost is the importance of delivering the ad to the target viewer, thus increasing the marketer’s video advertising effectiveness. While audiences are consuming the entire ad, the Cost Per Completed View (CPCV) goes down.

Expect a CPCV decline together with the maturity of the CTV market. In addition, an increase in view time from the heavy watchers, which are the 55 and above demographics, will also make AVOD more consumable like the traditional TV. Fred Arbel, SVP and Chief Marketing Officer for U.S. Luxury at Coty, mentioned in his interview, “YouTube CTV Ads were a key driver of campaign impact, helping us connect with new audiences beyond the viewers we were already reaching on linear TV and YouTube’s mobile and desktop experiences,” says Arbel. “It also drove the most efficient lifts in purchase consideration and video view-through rate.”

YouTube: Gateway to Effective CTV Advertising

With the increase in CTV viewership, YouTube responded with an update on their CTV ad offering. Currently, the video giant owns 40% of the watch time among ad-supported streaming platforms. With YouTube expanding its space in the CTV world, Strike Social’s proprietary tool will continue to evolve and improve CTV Ad performance and targeting capability.

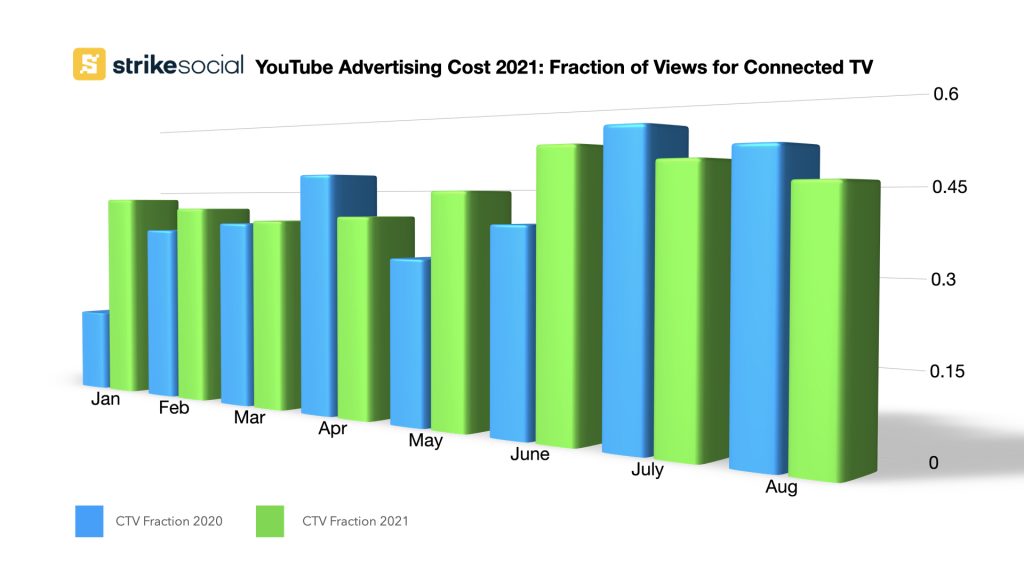

Looking at our data, the average CTV Fraction of our campaigns for 2021 is relatively similar to last year’s performance. Highlighting July and August this year, the CTV fraction improves to at least 10-12%. Even with the increase in demand and lack of CTV supply, costs remain inexpensive for CTV Advertising through YouTube.

Without a doubt, this is the best choice for marketers who want to maximize the cost of their :15 or :30 campaign as it produces the lowest Cost Per View against its competing video ad platform.

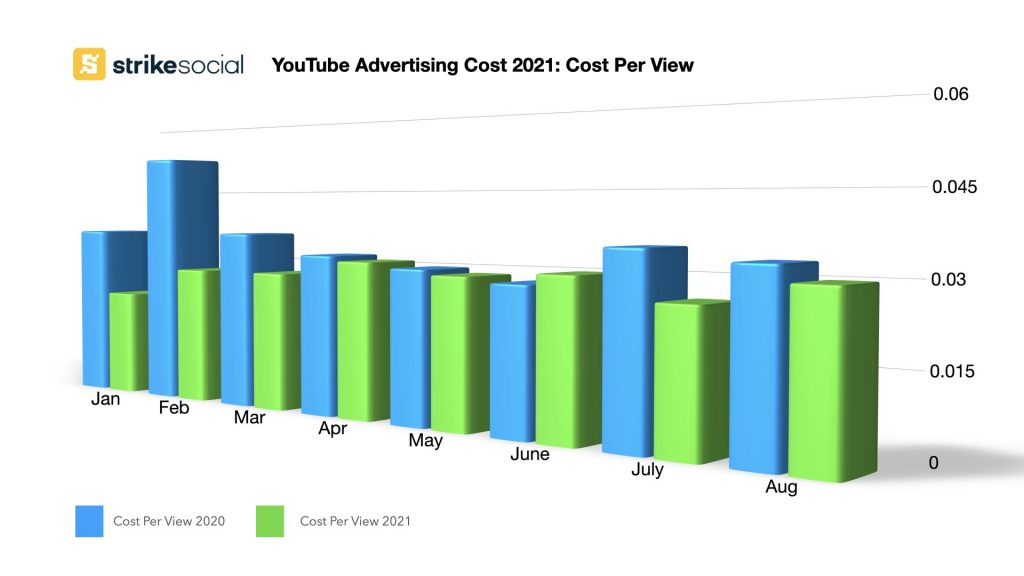

As digital ad spends rebound this year, increasing YouTube ads revenue by $7 Billion, together with the marketer’s demand, the CPV remains relatively the same. Strike Social clients saw an average of 9% reduction in CPV in August 2021 compared to last year. Concerning the clients with non-skippable ads, CPMs are either similar or below 2020 costs.

One of the reasons why YouTube CPVs are stable is the incredibly high supply and unique users consuming Youtube content and the rise of Youtube Connected TV share.

For advertisers who want to capitalize on the growth in CTV, work with a trusted supplier that can aid and scale your campaign, provide key data points, and guarantees results. It’s what we at Strike Social aim to provide for our clients.