Strike Overview

- Just a few days after the big event, how can advertisers continue driving post-Amazon Prime Day sales? This event holds significant importance for retailers and consumers, as it generated approximately $24 billion in purchases within its 4-day duration.

- This year, 46% of U.S. households seized Prime Day deals, with at least $200 in average spend, seizing different discounts and promotions from various stores and brands.

- Given the momentum Prime Day generates for retail advertisers, maintaining consumer interest beyond the event itself is essential. See Strike Social’s tips and strategies to maximize sales beyond Amazon Prime Day 2025.

Jump to Section

This post was updated in July 2025 to provide you with the latest information.

The Prime Day Halo Effect: Key Strategies for Post-Amazon Prime Day Advertising

Your post-Amazon Prime Day advertising strategy should begin the moment the 4-day event has ended. For many brands, the end of the Prime Day sales blitz triggers an immediate pullback on ad spend, a seemingly strategic move that feels like a cost-saving measure. But what if you’re actually missing out?

This critical period is called the Prime Day “halo effect,” a period when consumer purchase intent remains incredibly high even after the official deals end. For advertisers, this represents a strategic opportunity that most brands miss entirely.

We analyzed this year’s ad campaigns on YouTube, Facebook, and TikTok from July 1 to 19 to give you a clear-eyed view of the trends. Below, we’ll break down the data and give you an actionable post-Amazon Prime Day advertising strategy to capture lingering demand and drive growth while others are sitting on the sidelines.

Paid Social Performance Before, During, and After Prime Day

When a major retail event like Amazon Prime Day hits, the ad auction becomes a battlefield. Costs spike as brands flood the market. However, our analysis reveals different shifts in the weeks before, during, and after the 4-day event concludes.

Here’s a snapshot of the key performance changes we observed:

How Are YouTube Ads Performing?

YouTube is the ideal platform to engage a massive audience that remains in a “shopping season” mindset.

In the run-up to the event, brands leverage it for upper-funnel awareness, using skippable and bumper ads to build consideration and get their products on shopping lists. During the sale, it becomes a powerful conversion driver. But the true efficiency of YouTube ads shines during post-Amazon Prime Day advertising campaigns.

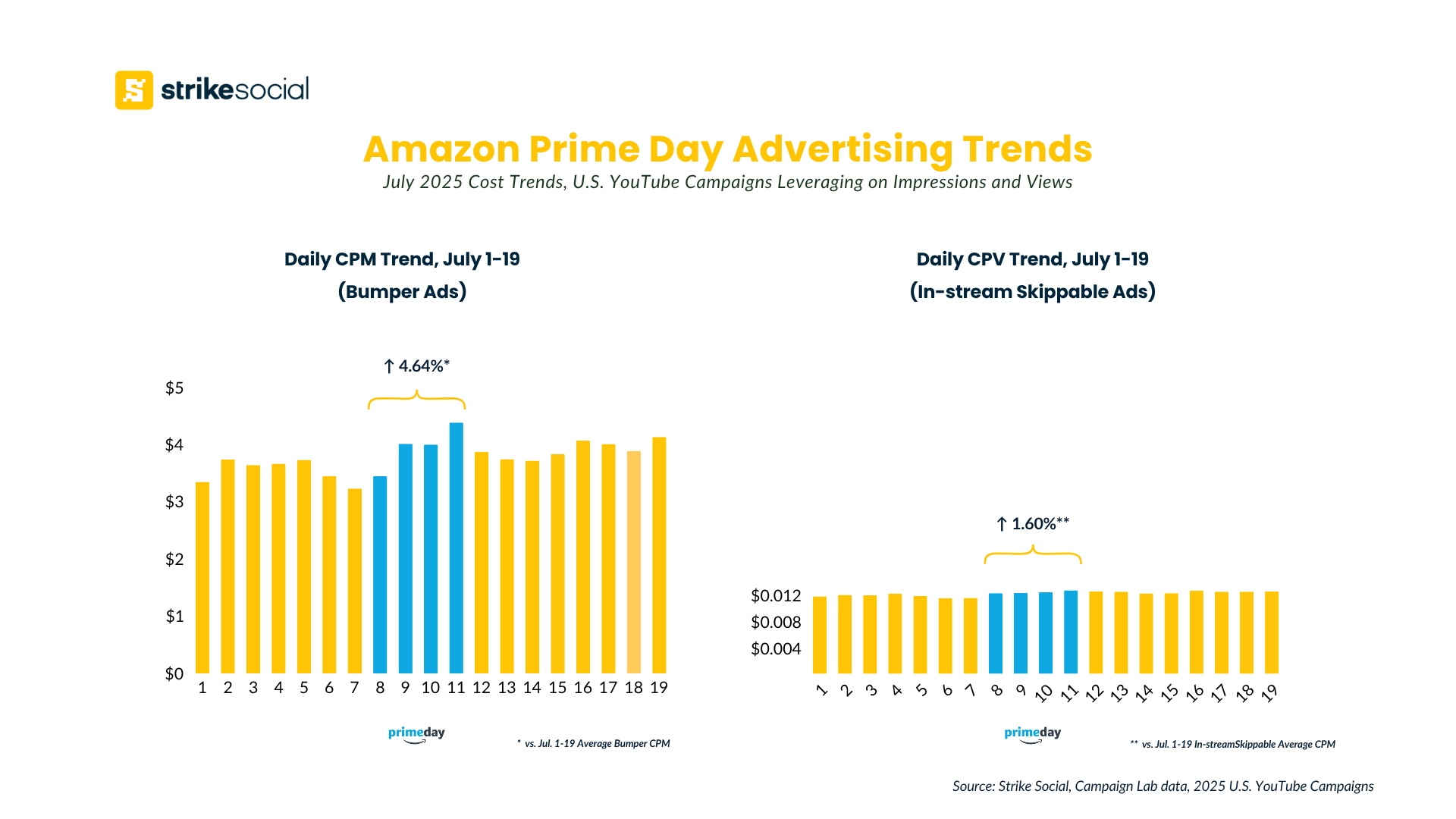

Awareness & Views (Bumper & Skippable Ads): During Prime Day week, competition heated up as expected. Bumper ad CPMs jumped 12% and skippable ad costs per view went up 5% compared to the week before. But here’s the interesting part: in the week after Prime Day, costs started to level out while view rates actually improved.

Well, what does this mean for YouTube advertisers? Your awareness campaigns can maintain solid performance without the Prime Day price premium. The audience is still in shopping mode, but you’re not competing with every other brand for their attention.

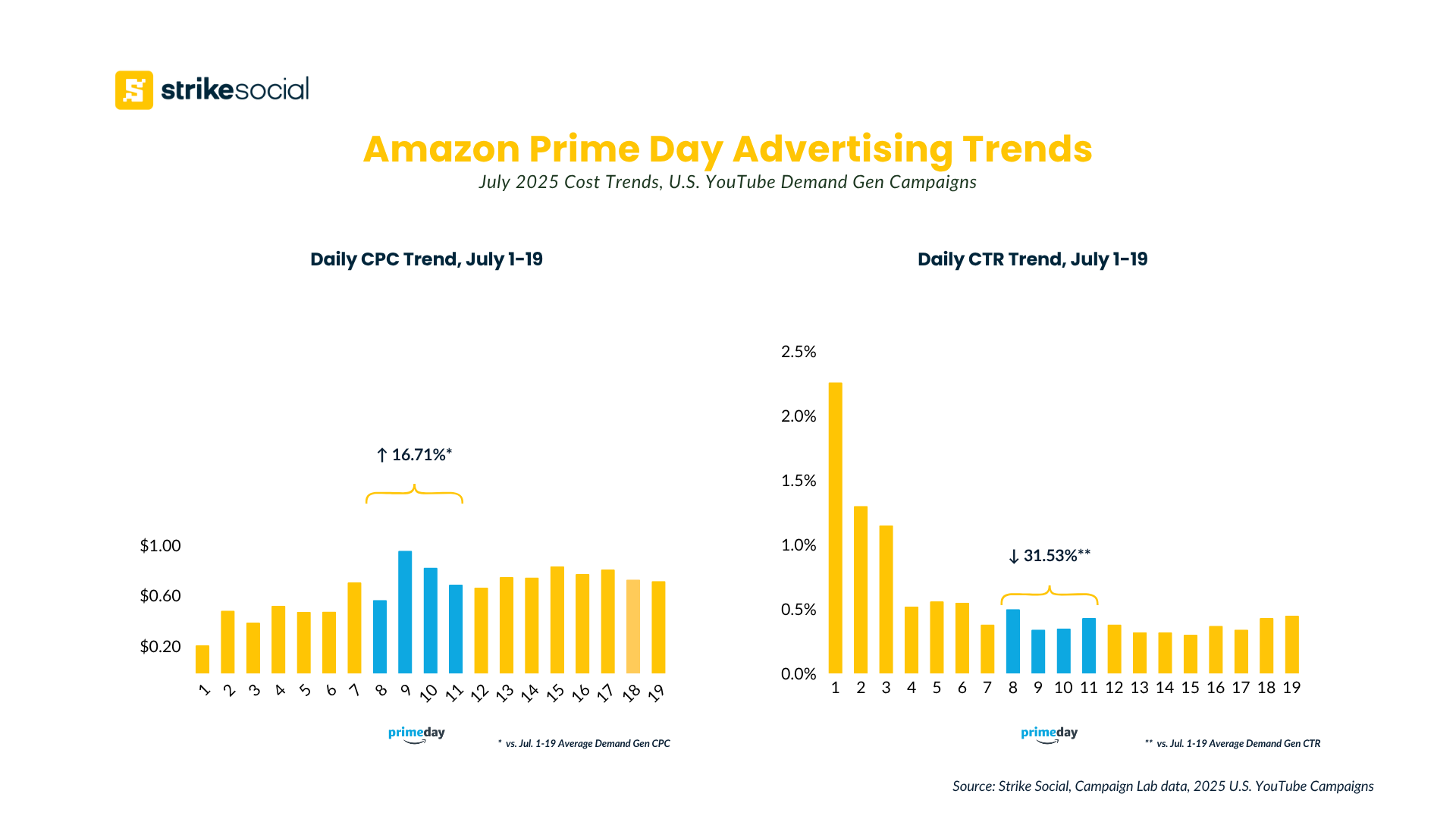

Traffic & Action (Demand Gen): Early July was the sweet spot for YouTube Demand Gen campaigns, with higher click-through rates and lower costs per click about a week before Prime Day hit. Once the event started, costs predictably went up while engagement went down.

If you’re running traffic and action-focused campaigns on YouTube, you should front-load your spend before the major shopping events rather than trying to compete during the frenzy.

Q1 2025 YouTube Ads Trends Are In, Here’s What You Need to Know

With Q1 2025 showing efficiency gains across formats, now’s the time to refine your YouTube advertising strategy. Get the latest benchmark report to guide your YouTube campaigns for the rest of the year.

Retargeting Opportunities with Facebook Ads

Facebook is one of the primary arenas for driving immediate sales through dynamic, targeted promotions. Our analysis of Facebook Feed ads during this period revealed that 90% of advertisements focused on immediate sales with direct calls-to-action like “Shop now” and “Send message.” This bottom-funnel focus drives up auction costs but also creates valuable audience data.

The competitive environment generates substantial pools of qualified audiences demonstrating purchase intent. Once Prime Day concludes, these audiences present significant retargeting opportunities at more efficient cost structures.

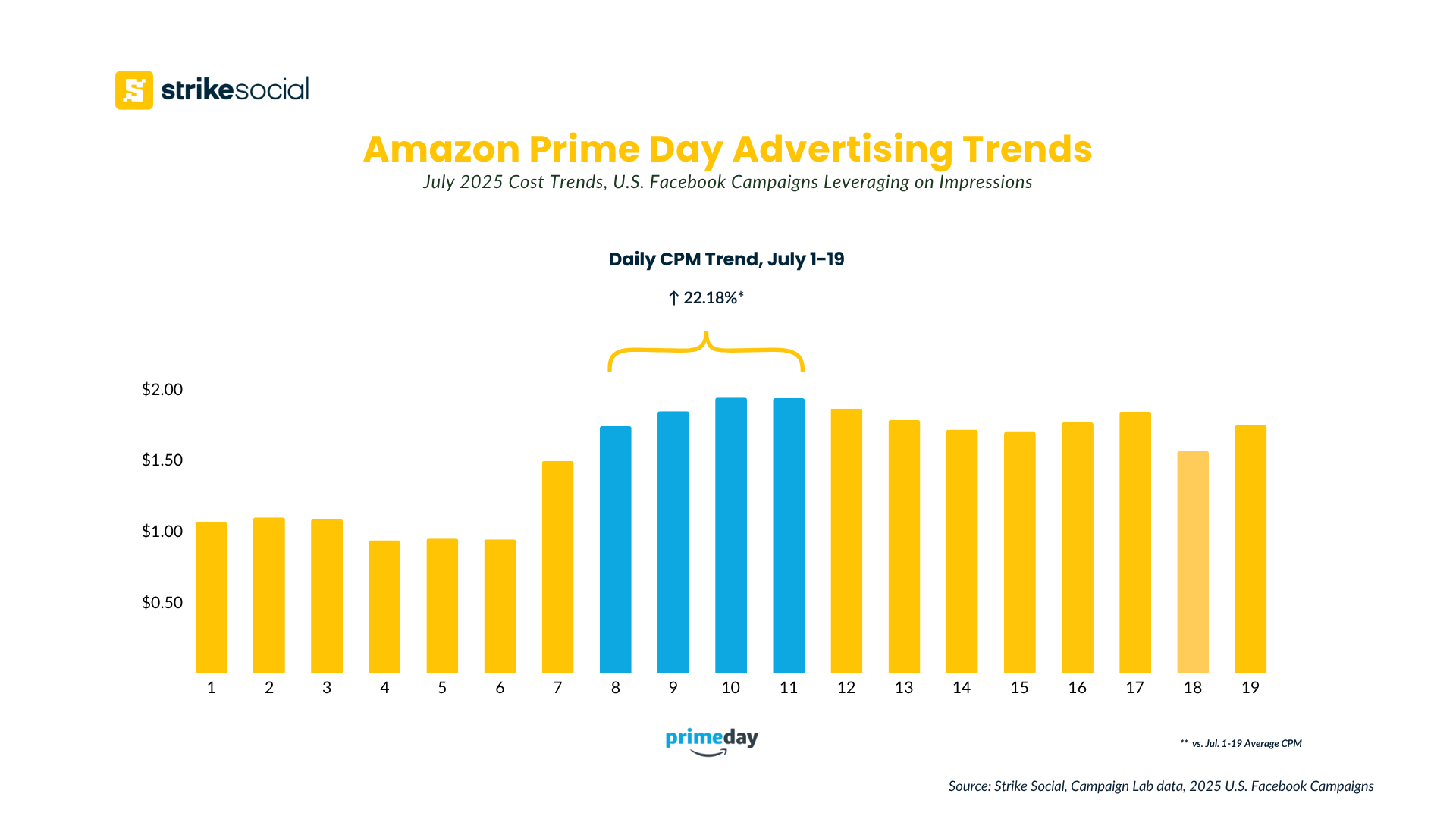

Cost of Reach (Impressions Campaigns): Facebook awareness campaigns during Amazon Prime Day see a 72% cost increase compared to early July, with costs remaining elevated after the event. This pattern suggests that awareness-focused campaigns achieve better efficiency when scheduled in the weeks preceding Prime Day rather than during or immediately after the event.

The sustained Facebook ad cost hike reflects broader advertising calendar dynamics, as Prime Day precedes other significant commercial periods, including back-to-school and Q4 holiday preparation.

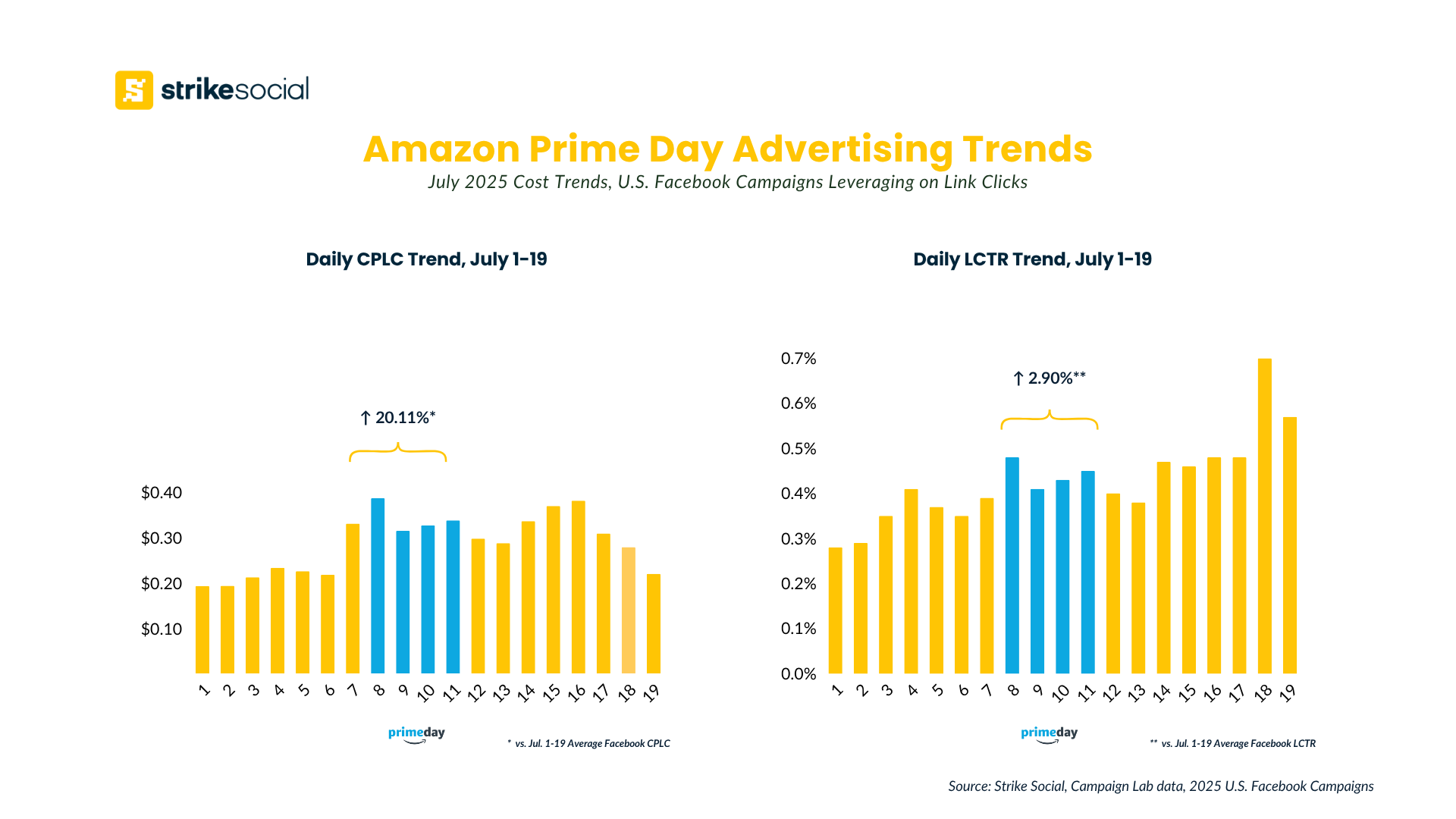

Cost of Traffic (Link Clicks Campaigns): Traffic-focused campaigns demonstrated clear post-Prime Day advantages. While costs increased predictably during the event week, they declined substantially the following week as click-through rates improved simultaneously.

This timing creates optimal conditions for retargeting campaigns. Website visitors, ad engagers, and product browsers from the Prime Day period remain in consideration phases while advertising costs decrease. The result is more efficient access to warm audiences with demonstrated interest, making the post-Prime Day week the most cost-effective Facebook advertising period for traffic generation from high-intent users.

Facebook Ads in Q1 2025: What the Numbers Reveal

From awareness to action, our Q1 Facebook report captures the latest performance benchmarks. Get the data on Advantage+ usage and how advertisers are optimizing for better results.

TikTok Ads See Sustained Engagement

TikTok’s advertising environment remained remarkably stable throughout the Prime Day period, reinforcing its position as a reliable channel for product discovery and purchases.

Research indicates that Gen Z audiences frequently turn to TikTok to discover products they later purchase during major shopping events like Amazon Prime Day. This behavior pattern creates sustained engagement opportunities beyond the official sale period.

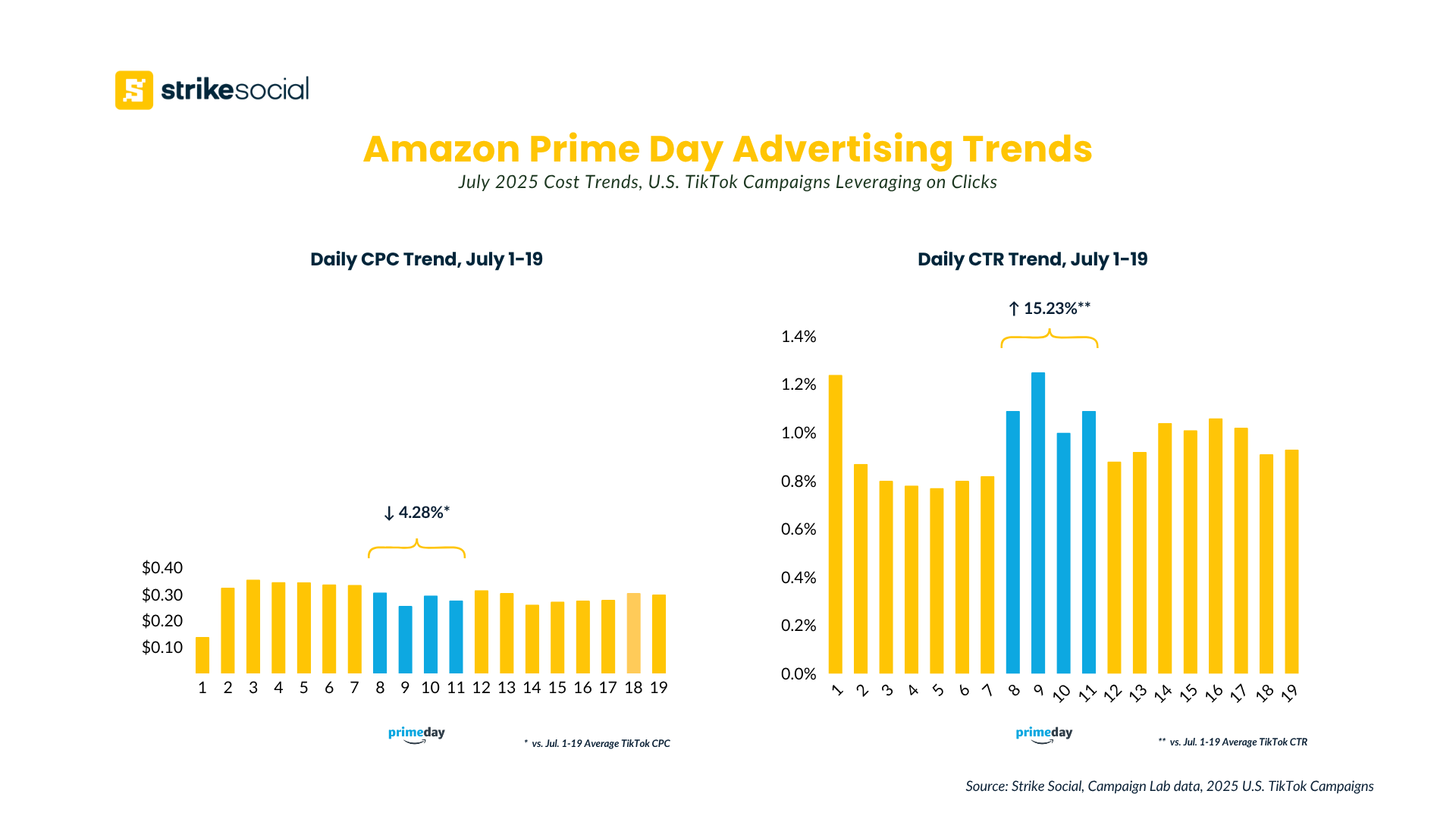

Clicks Campaign Performance: TikTok demonstrated counter-intuitive cost behavior during Prime Day week. While most platforms saw cost increases, TikTok CPCs declined by 9% during July 8-11 compared to the previous week, while maintaining strong click-through rates.

This cost efficiency continued post-Prime Day, with TikTok campaigns sustaining both performance levels and cost effectiveness. The platform’s algorithm appears less susceptible to the auction pressures that affect other channels during high-competition periods.

4 Tips to Maximize Your Post-Prime Day Advertising Campaigns

Let’s turn these insights into a winning post-Amazon Prime Day marketing strategy. This is how to optimize Prime Day advertising campaigns in 2025 by looking beyond the sale itself.

1. Double-Down on Retargeting

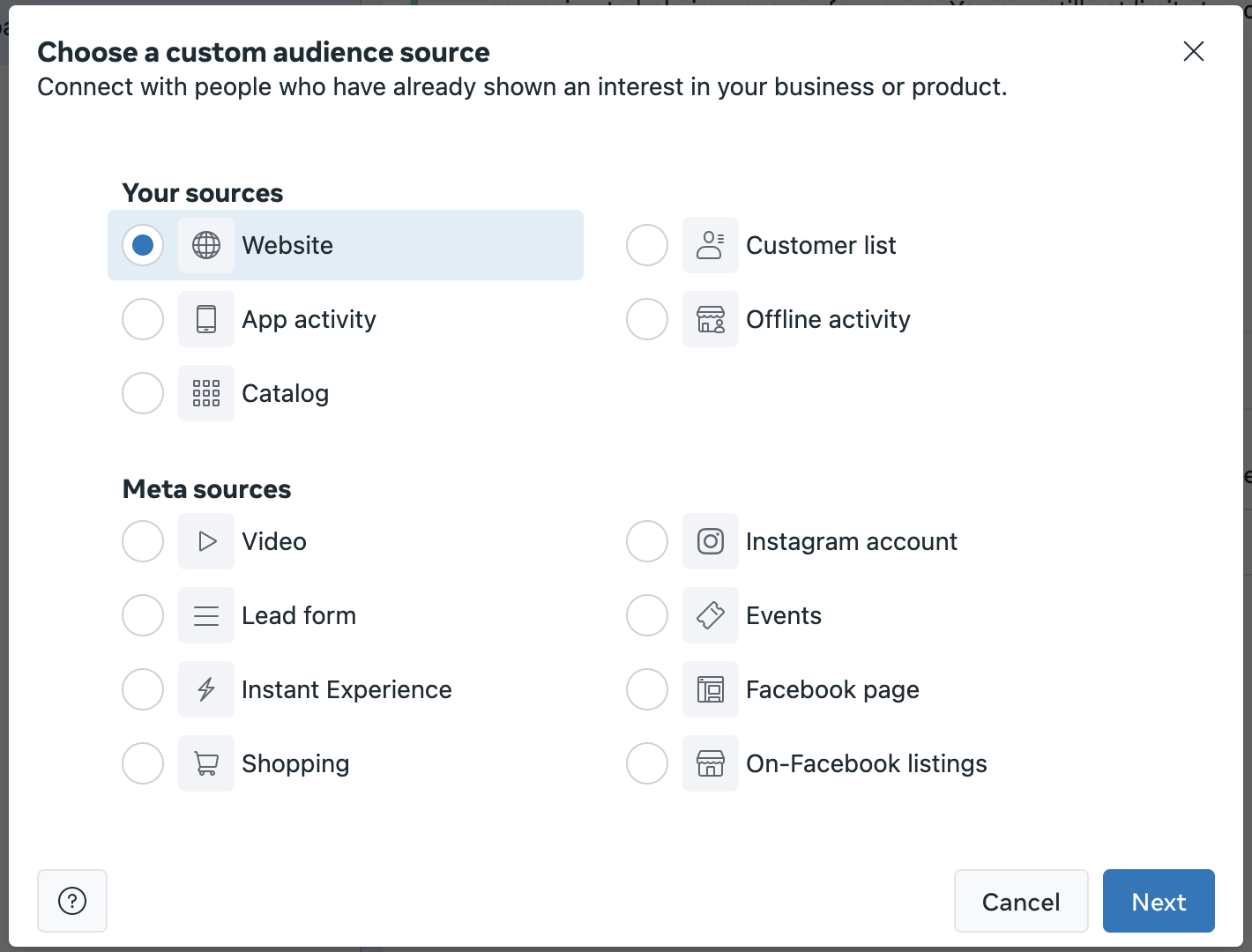

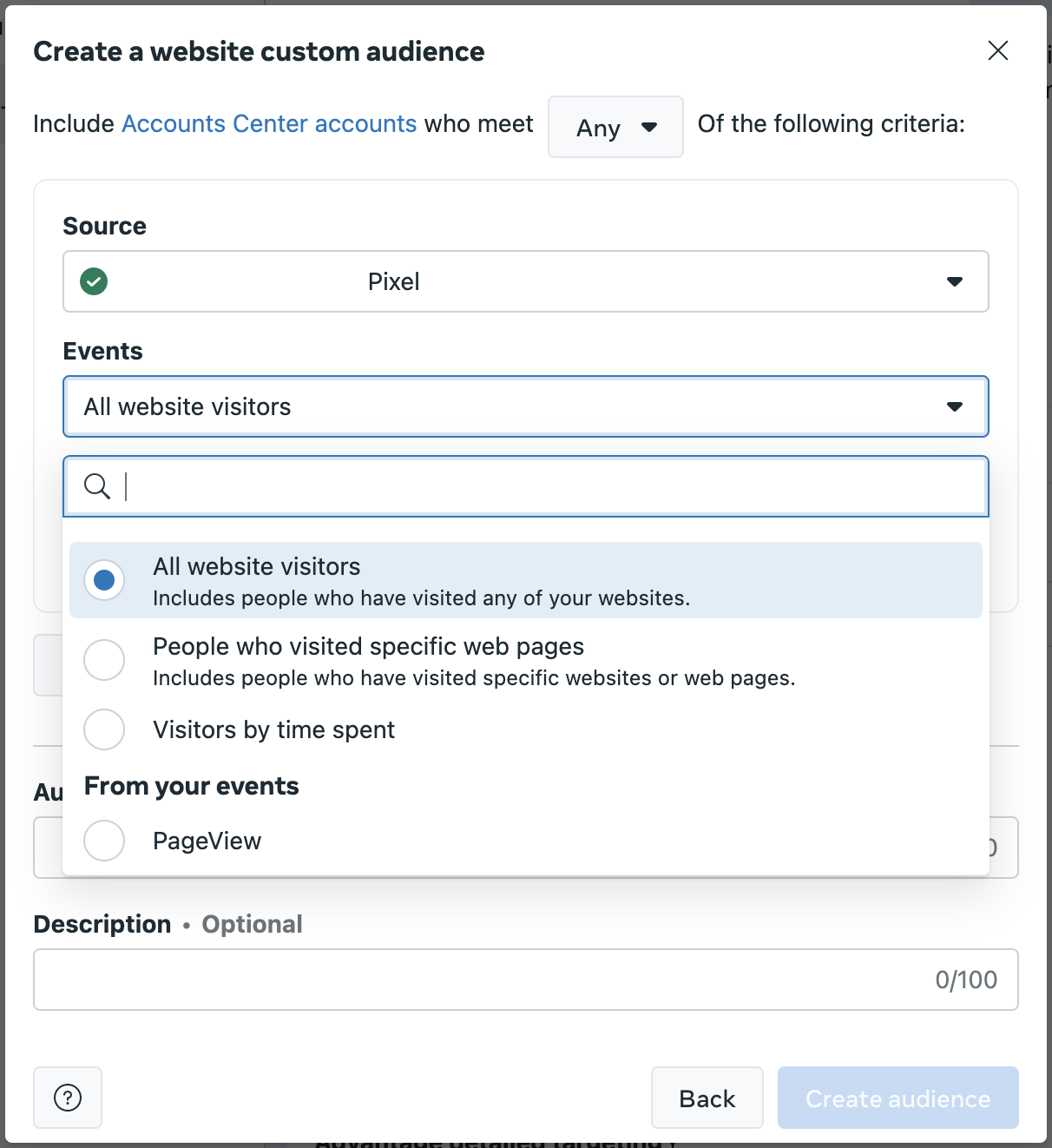

Focus on retargeting audiences who showed interest during the event but didn’t make a purchase. The audiences who browsed your site, engaged with your Amazon Prime Day ads, or abandoned a cart are primed to convert. During the Prime Day week, gather enough data to create an audience list for remarketing immediately after the event.

For instance, if you used a landing page for your Amazon product links, ensure your platform pixel (e.g., Meta pixel) is installed to capture website visit data. This allows you to retarget users who clicked on your landing page and find similar customer profiles who are likely to choose you for their Amazon shopping.

2. Sustain Brand Recall Post-Prime Day

Your campaigns during Amazon Prime Day cast a wide net, but many potential customers miss out or are still looking for alternatives. After Amazon Prime Day concludes, leverage your campaign insights to drive future awareness and consideration-focused campaigns. If you’ve achieved your sales goals during this period, now is the time to ensure your brand remains prominent outside peak Amazon shopping seasons.

Awareness and consideration campaigns:

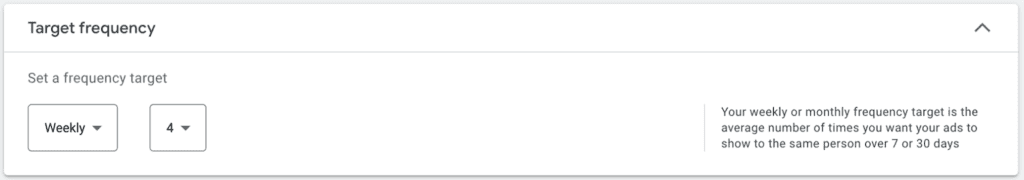

Aim for an effective frequency of ‘three-plus’ exposures. This means your ads should be seen by each audience member at least three times to ensure they leave an impact and are remembered.

One effective approach is using a Video Reach Campaign with targeted frequency settings, allowing your Amazon shopping ads to be shown up to 4 times weekly or 8 times monthly to the same viewer.

Sales campaign:

Did you know that after a customer’s first purchase, there’s a 27% chance they will buy again? This likelihood increases to 49% after their second purchase and jumps to 62% after their third. Don’t halt your sales efforts just yet — capitalize on post-Amazon Prime Day sales to clear excess inventory and retain customer loyalty.

3. Maintain Brand Momentum with Cost-Effective Awareness

While your competitors go silent, you can dominate and get a step ahead for the next major holiday advertising periods.

In particular, YouTube Bumper ads and non-skippable formats provide effective vehicles for broad awareness campaigns during this window. The objective shifts from immediate conversion to maintaining brand consideration for future purchase decisions.

YouTube’s stable CPMs and CPVs in the post-Prime Day period create favorable conditions for awareness building. This cost efficiency allows brands to establish a stronger market presence while competitors scale back, ultimately improving competitive positioning for subsequent significant shopping periods throughout Q3 and Q4.

Further Reading

Reimagine Awareness Campaigns with Google TV and YouTube CTV

Today’s audiences aren’t just on phones. With the rapid growth of YouTube CTV and Google TV, advertisers have new opportunities to drive brand recall by meeting viewers where they are most immersed and focused.

4. Coordinate your Post-Amazon Prime Day Advertising Strategy with The Team

Once you’ve gathered all data and identified successful strategies, you can convene with your client or agency to strategize for your post-Amazon Prime Day advertising campaigns.

Aligning your media buying team’s strategy with your target Amazon shopping sales is essential for maximizing your brand’s ROAS (return on ad spend) and achieving optimal results from your paid social media ad campaigns. This alignment ensures that both teams are on the same page. In contrast, the media buying team optimizes Amazon shopping ad performance using machine learning and AI; the sales team can provide insights and direction to enhance overall effectiveness.

As you transition into the post-Prime Day phase, run a brief cross-functional kickoff to align sales, media buying, and analytics on goals, timelines, and communication. Use a project kickoff checklist to structure the agenda, define KPIs, surface risks, and assign owners for rapid execution.

A significant advantage is having a responsive media buying team capable of 24/7 optimization. At Strike Social, our teams leverage advanced technology and media buying expertise to achieve desired KPIs while optimizing costs. This approach ensures that your Amazon Prime Day advertising campaigns perform well even after the event, maintaining strong brand visibility and audience engagement.

Explore how Strike Social’s data-driven approach delivers measurable results for your campaigns. Contact us here and find out how our experienced team can help you reach your social media advertising goals.

Join Strike Social’s growing network of successful clients.

Get a personalized walkthrough of our ad activation and management tools from our expert team.

Article by

Lee Baler, Strike Social’s VP of Sales & Strategy

Lee leads global strategy, helping clients and agencies maximize YouTube and paid social performance. Constantly tracking industry trends, he translates insights into strategies that help brands stay competitive and achieve sustained profitability.