Strike Overview

- Understanding the latest YouTube ads statistics is key to planning efficient, performance-driven campaigns across the funnel.

- With ad spend reaching $8.92 billion in Q1 2025, YouTube’s continued growth is driven by a mix of new formats, stronger AI integration, and expanding user behavior across mobile and TV screens.

- This blog combines Strike Social’s internal insights with global YouTube advertising trends to help uncover where and when your campaigns can scale efficiently across local and international markets.

Jump to Section

YouTube Advertising Data and Insights: 15 Global Trends to Guide Your Next Campaign

YouTube’s growth trajectory has been both rapid and global, surpassing even Netflix in viewership and cementing its place as the leading platform for video marketing. While TikTok continues to rise, YouTube remains unmatched in its ability to dominate both mobile screens and connected TVs (CTV), making it a go-to channel for full-funnel strategies.

At Strike Social, we’ve optimized YouTube campaigns at scale, backed by our internal benchmarks and our proprietary ad tech to adapt to shifting platform behaviors. In this blog, we’ve compiled the most relevant YouTube ads statistics and global data trends marketers should know to stay ahead.

15 YouTube Ad Stats Every Marketer Should Know

Global Performance Insights

- AI-optimized formats like Video View and Demand Gen are proving to be some of the most cost-effective YouTube ad strategies, delivering lower CPAs and improved reach.

However, their success hinges on strong optimization inputs. Without localized targeting or high-impact creatives, engagement rates may drop, revealing that even the smartest automation still needs a human touch. In the age of AI, you don’t have to give up control; you just need to guide the algorithm with better creative and audience signals.

- Across our internal campaigns and industry-wide YouTube ads statistics, Q2 emerged as the most stable quarter for full-funnel campaign performance. CPMs held steady, view rates steadily improved, and CTRs began to rise, making Q2 a strong launchpad for both awareness and performance objectives. It’s a key window to scale reach and test new creatives before the saturation of Q4.

- If Q4 is your conversion battleground, Q3 should be your optimization runway. With CTR and CPC beginning to shift, brands can use Q3 to refine creatives, test bidding strategies, and build momentum, positioning for conversion-heavy Q4 campaigns. Brands that use Q3 for tuning rather than just testing tend to enter Q4 with lower CPAs and stronger engagement rates.

- H1 campaigns generally delivered more predictable cost metrics, while H2 campaigns showed sharper spikes in engagement, especially during seasonal moments. YouTube ad trends also showed a recurring pattern: CPMs typically rise in Q1, normalize in Q2, and fluctuate in Q3 depending on external market factors. Notably, even in the high-demand Q4 of 2024, cost levels were more efficient than expected: an encouraging signal heading into Q4 2025.

- TrueView Skippable Instream ads, often used for reach, performed surprisingly well across the funnel. When paired with the right audience and contextual targeting, they consistently delivered high view rates and solid CTRs, especially in Q2 and early Q3. For cost-sensitive periods, this format offers flexibility: it bridges awareness and clicks with a single asset without increasing spend.

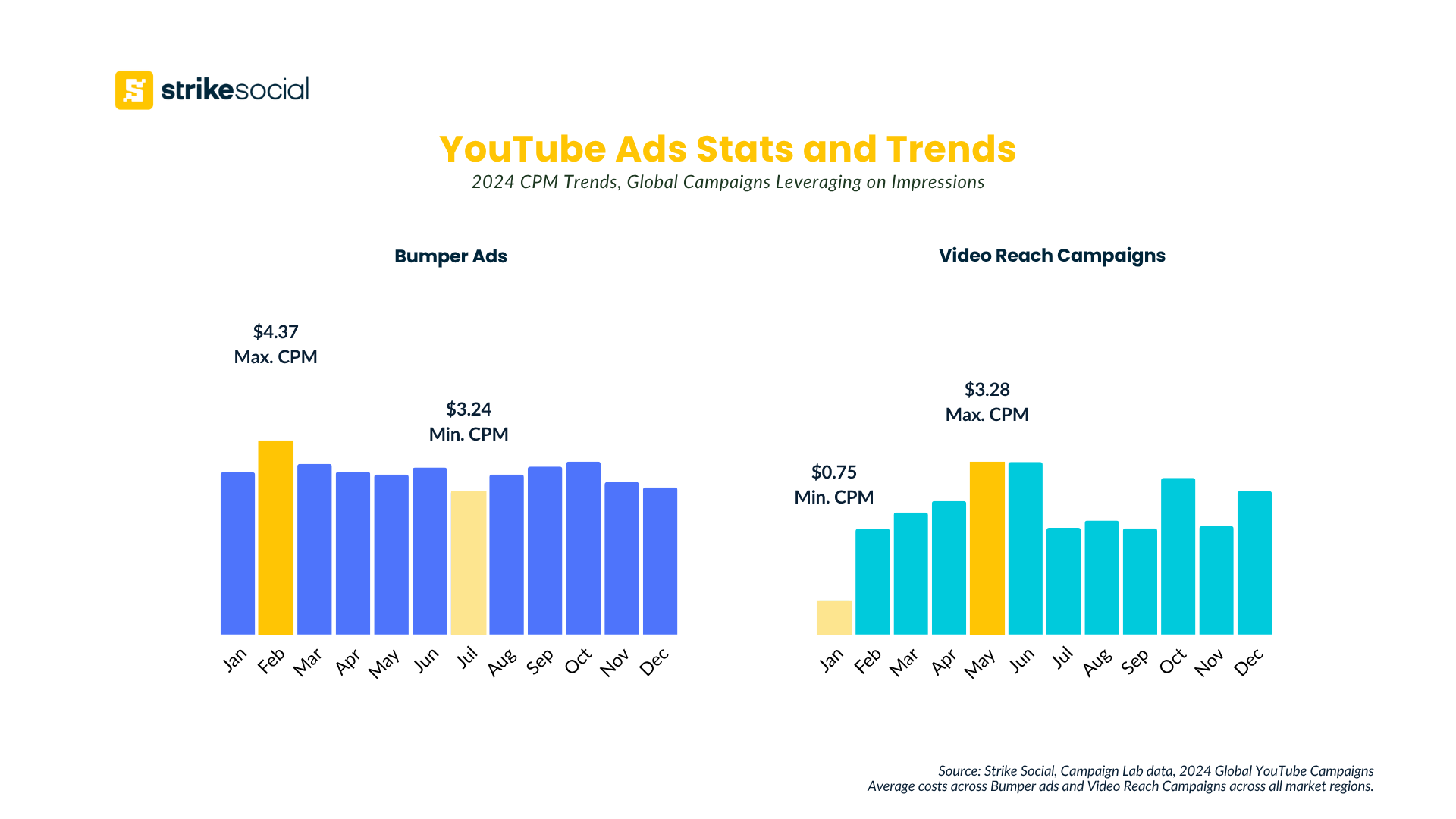

Awareness Metrics: CPM Trends and Best Practices

- Our YouTube ad stats show that Q1 consistently starts with renewed advertiser activity, as brands re-enter the market with fresh annual budgets. January alone saw a global 25% increase in CPMs, ranging from $3.98 to $4.35 across formats, compared to December’s post-holiday lows. This surge reflects heightened competition, particularly in EMEA, where events like Valentine’s Day drove up to £1.37 billion spending in the UK alone.

- December proved to be a hidden opportunity for awareness campaigns, with CPMs trending lower than forecasted, even amid the holiday rush. As most advertisers poured spend into bottom-funnel campaigns, upper-funnel placements were left less competitive. This presented a prime chance for brands with leftover budgets to extend reach cost-efficiently before year-end.

- Shorter, high-frequency placements like 6-second bumper ads maintained steady CPMs within $3.24 to $4.37 year-round. These quick-hit ads continue to effectively build top-of-mind awareness, especially when deployed across a range of YouTube video content.

- Video Reach Campaigns emerged as the global standout, delivering up to 40% better CPM efficiency than the overall average. For advertisers focused on scaling reach across the YouTube platform, this format balances volume, cost, and campaign simplicity.

* Data reflects 2024 performance from YouTube Bumper, Video Reach, and TrueView In-stream Non-skippable campaigns focused on awareness across APAC, EMEA, and North America markets. Campaign outcomes vary based on factors such as audience targeting, bidding strategy, creative quality, and campaign duration.

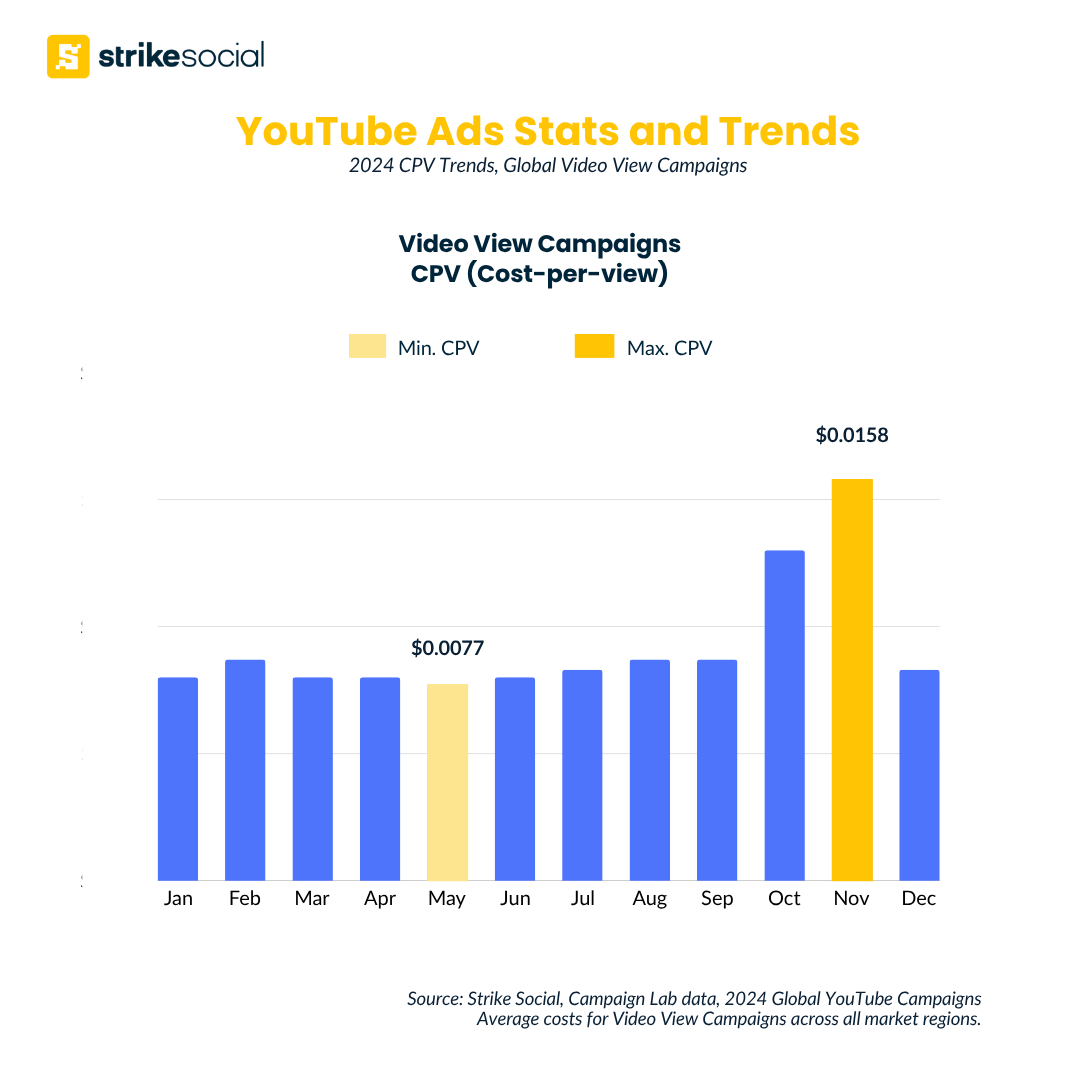

Engagement Metrics: CPV and View Rates (VR)

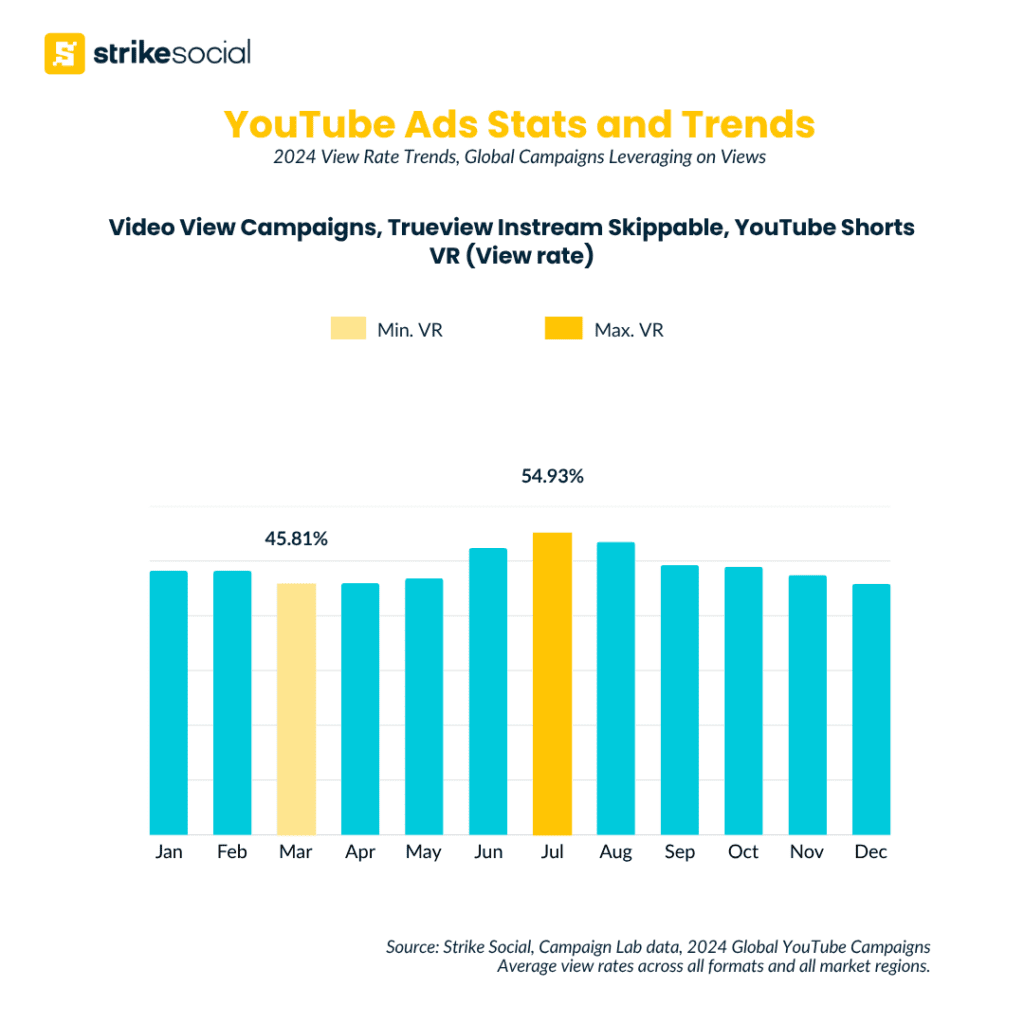

- YouTube statistics from Strike Social campaigns reveal that viewer engagement peaks mid-year, with global average view rates (VR) reaching nearly 55% in July. This surge aligns with increased summer video consumption, holidays like the Fourth of July, and seasonal events like Amazon Prime Day. As Q3 kicks off, it also marks the ramp-up for Q4 campaigns, making July a strategic period for views-focused campaigns to gain early traction.

- Video View Campaigns delivered the lowest CPVs globally, with APAC markets seeing up to 45% greater efficiency than the global average. However, this came with a trade-off: lower engagement rates. The results suggest that while Google’s AI can optimize for low-cost views, it may not always deliver placements that drive deeper interaction, especially if the targeting isn’t primed for its best audiences.

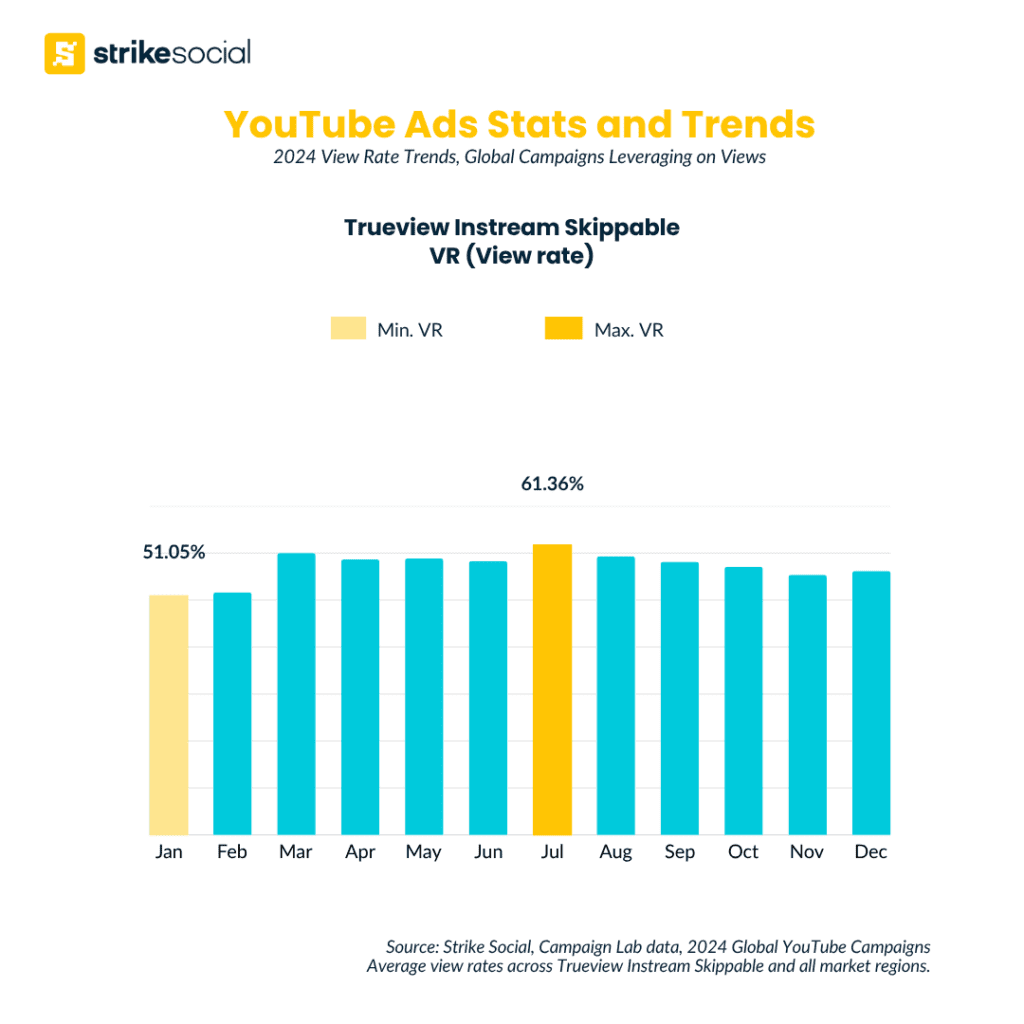

- TrueView Instream Skippable ads consistently proved to be the most reliable for balancing cost and engagement. With VRs up to 66% and CPVs 8.5% below average, this format delivers strong performance for brands aiming to scale views globally. When paired with the right creative and targeting, skippable ads become a high-value format, reaching engaged viewers at scale while offering skip flexibility.

Further, TrueView Instream Skippable ads outperformed other formats in the US and Canada in view rate, peaking at 66.08% in May and averaging over 60% from April to August, indicating strong mid-year viewer engagement.

* Data reflects 2024 performance from YouTube Video View, Trueview Instream Skippable, and YouTube Shorts campaigns focused on views across APAC, EMEA, and North America markets. Results may vary depending on targeting precision, budget allocation, industry vertical, and market conditions.

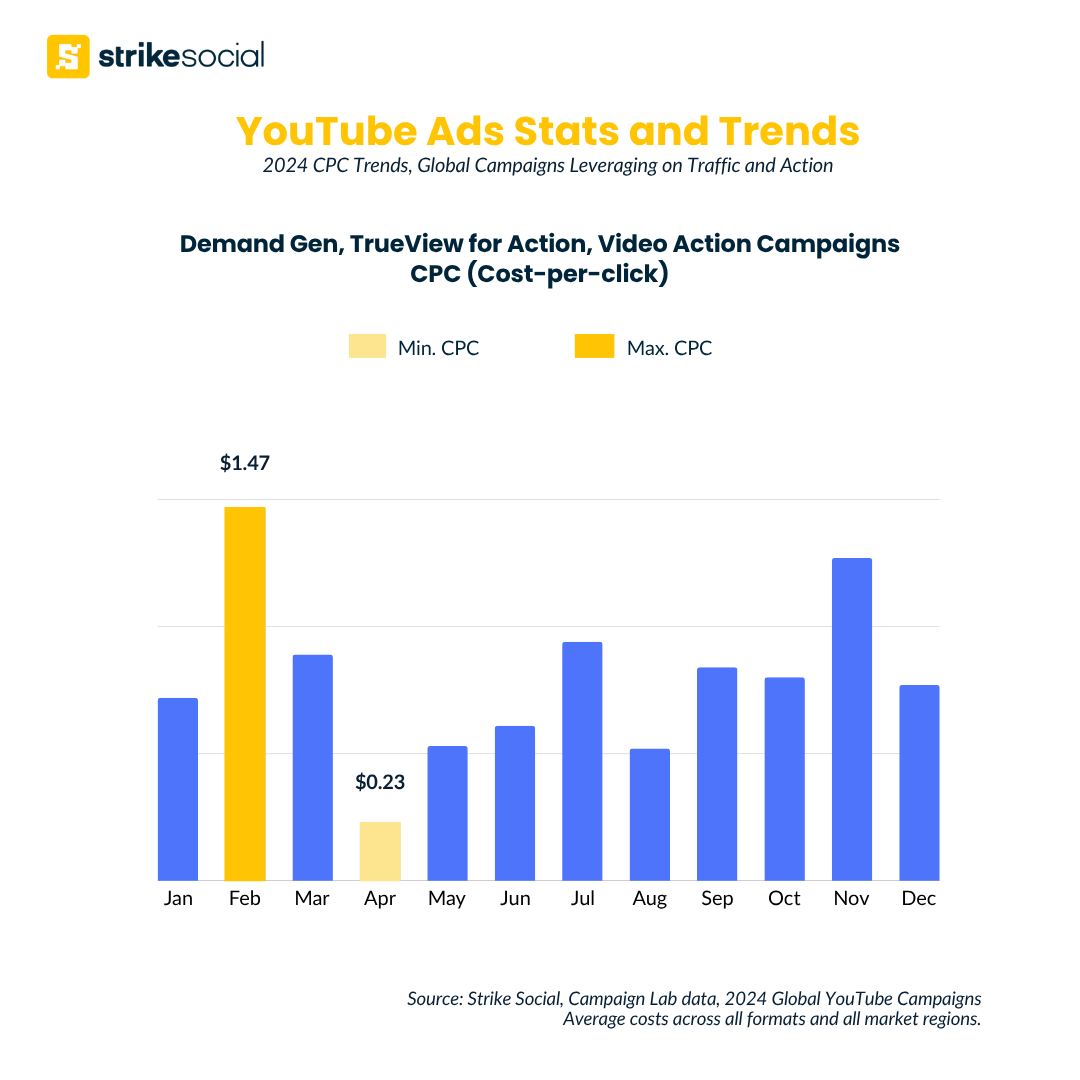

Traffic and Action Metrics: CPC, CTR, and Demand Gen Trends

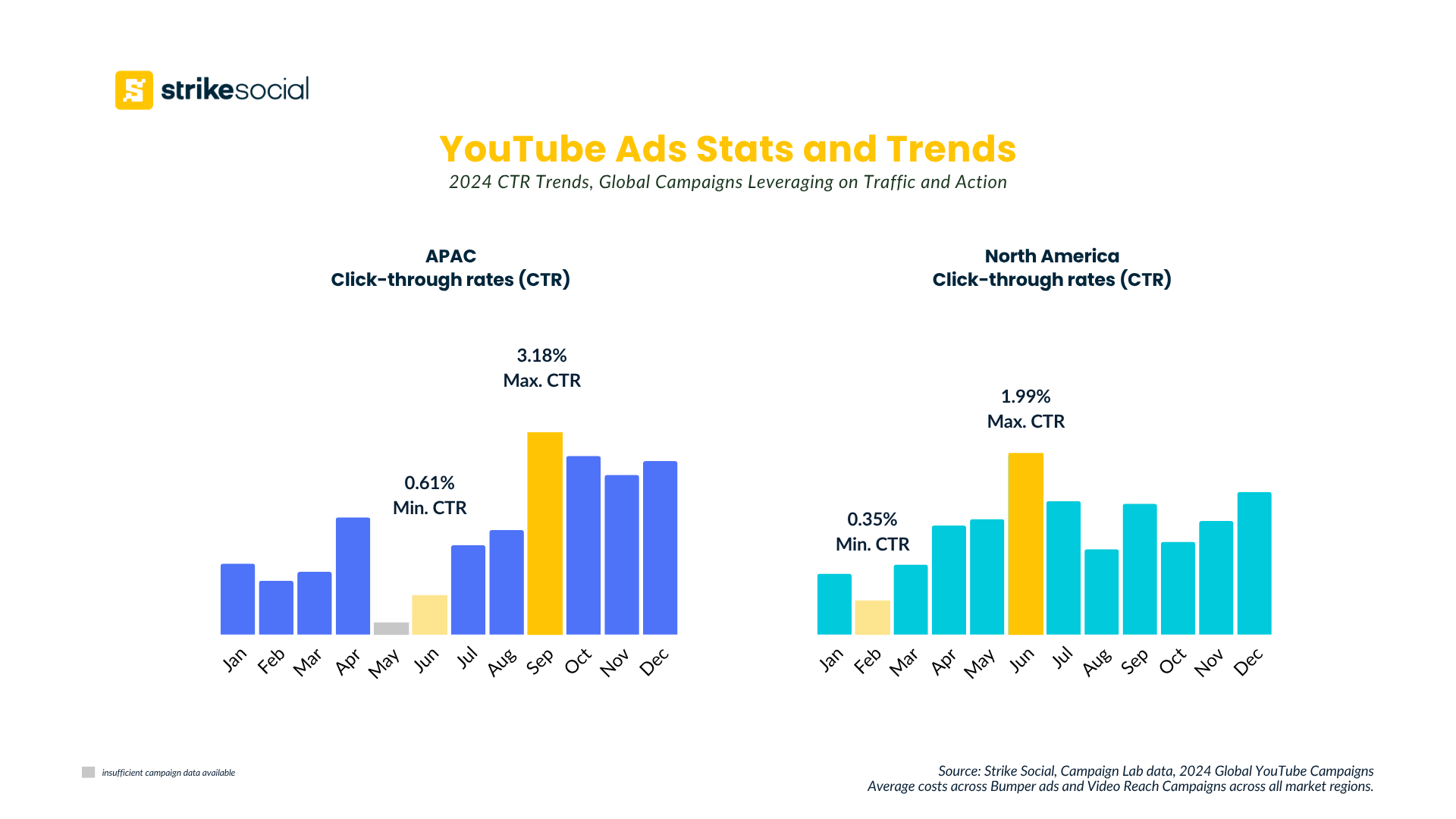

- Our YouTube ads statistics reveal a consistent year-long improvement in CTR performance for clicks-focused campaigns. This indicates that audience responsiveness grows as campaigns build momentum, particularly in the lead-up to peak seasons. Consumers tend to become more click-ready even before holiday discounts hit, offering a valuable window for brands to drive traffic and action earlier than expected.

- Though relatively new, Demand Gen campaigns delivered high-efficiency CTR spikes, peaking at 2.61% in December across North America. This late-year surge suggests that pairing intent-driven formats with smart audience signals can significantly boost engagement in a crowded ad environment. During December alone, Demand Gen outperformed Video Action Campaigns by 61% in click efficiency, an impressive result considering the intense competition during Q4 YouTube advertising periods.

- CTR performance for conversion formats accelerated in the second half of the year. In the U.S., October through December saw stronger results, likely due to better alignment of campaign messaging and promotional timing. Meanwhile, in APAC, CTR surged by up to 138% during Q4, signaling a major opportunity for brands looking to scale YouTube ad campaigns in the region.

* Data reflects 2024 YouTube ads statistics from Demand Gen, TrueView for Action, and Video Action campaigns focused on traffic and action across APAC, EMEA, and North America markets. Variables such as regional competition, seasonality, ad placement, and optimization settings may impact campaign outcomes.

YouTube Advertisers’ Outlook

No matter the market or season, data-driven strategy remains the foundation of effective YouTube advertising campaigns. The YouTube ads statistics and trends shared above provide a clear roadmap for navigating platform performance across awareness, views, and action-focused goals.

While AI continues to enhance cost-efficiency and campaign automation, especially in formats like Demand Gen and Video View Campaigns, manual optimization remains essential. As AI can handle data analysis and audience predictions, the difference lies in strategic input: knowing when to test, when to scale, and how to adapt to shifting audience behaviors.

That’s where Strike Social comes in. Our proprietary tech supports automation, but it’s our expert media buyers who bring context to the data, layering in creative testing, bid strategies, and platform expertise to stay ahead of evolving YouTube trends. We help brands adapt to algorithm changes, align campaigns with regional signals, and ensure long-term efficiency across the funnel.

As you refine your YouTube ad strategy for 2025, think beyond isolated campaigns. YouTube works best when deeply integrated into a full-funnel marketing mix, supporting discovery, action, and brand growth.

Looking to stay ahead of industry shifts and maintain consistency in performance? Request a demo to see how Strike Social helps brands drive results on YouTube through precision, adaptability, and a sharp focus on cost efficiency.

Article by

Lee Baler, Strike Social’s VP of Sales & Strategy

Lee leads global strategy, helping clients and agencies maximize YouTube and paid social performance. Constantly tracking industry trends, he translates insights into strategies that help brands stay competitive and achieve sustained profitability.